Issue:

107

Page: 52-59

Herbal Dietary Supplement Sales in US Increase 6.8% in 2014

by Tyler Smith, Mary Ellen Lynch, James Johnson, Kimberly Kawa, Hannah Bauman, Mark Blumenthal

HerbalGram.

2015; American Botanical Council

By Tyler Smitha, Mary Ellen Lynchb,

James Johnsonc, Kimberly Kawab, Hannah Baumana,

and Mark Blumenthala a HerbalGram,

American Botanical Council; Austin, Texas

b SPINS; Schaumburg, Illinois

c Nutrition

Business Journal, New Hope Natural Media; Boulder, ColoradoIntroduction

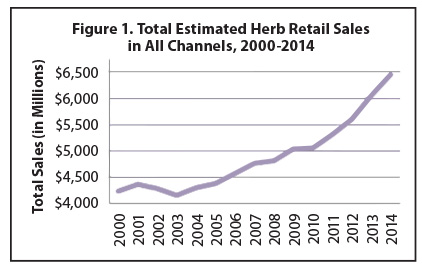

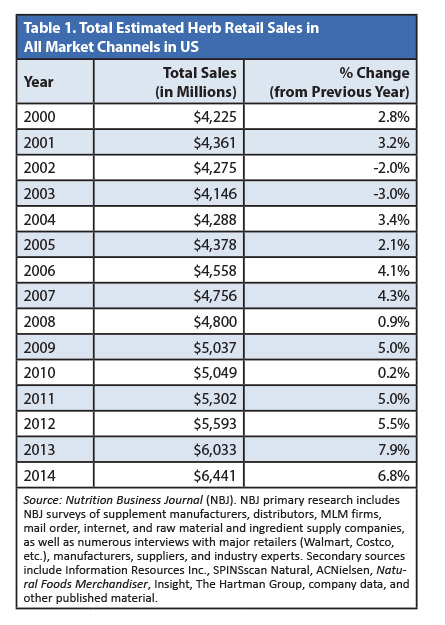

Total retail sales

of herbal dietary supplements in the United States increased by an estimated

6.8% in 2014 marking the 11th consecutive year of growth. This increase is

slightly less than 2013’s

7.9% increase, which was the greatest percentage sales jump since the late

1990s.1 Sales of herbal supplements have been increasing steadily

since 2002-2003 when the market experienced a brief, two-year dip in total

sales (Figure 1 and Table 1). Last year, American consumers spent roughly $6.4

billion on herbal supplements —over $1 billion more than was

spent in 2011 and $400 million more than 2013 — according

to aggregated market statistics provided by the Nutrition Business Journal

(NBJ).

The data in this

report correspond to retail sales of herbal supplements in three distinct

market channels — mainstream, natural, and direct

sales (Table 2) — as defined by NBJ and the

Chicago area-based market research firms SPINS LLC and IRI (Information

Resources, Inc.). Herbal supplement sales estimates do not include herbal teas,

plant-based natural cosmetic products (“cosmeceuticals”),

or over-the-counter (OTC) medications with US Food and Drug Administration

(FDA)-approved botanical ingredients such as psyllium (Plantago ovata, Plantaginaceae)

or slippery elm bark (Ulmus rubra,

Ulmaceae).

In 2014, for the

sixth year in a row, sales increased in each of these three channels (Table 3).

Herbal supplement sales from natural and health food stores experienced the

strongest estimated growth of 7.7%, while mainstream and direct sales increased

by 5.0% and 6.7%, respectively, from the previous year.

Mainstream Retail Channel

Sales of herbal

dietary supplements in the mainstream channel alone totaled $815,970,645 in

2014, as determined by SPINS and IRI. This figure represents a 2.1% increase over 2013 sales in this channel, which totaled just under $800 million (Table

4). NBJ — which

includes convenience store data in its mass-market channel — estimated

slightly higher sales of $1.12 billion.

Since 2013, SPINS

and IRI have collaborated to produce a combined data set for mainstream retail

sales; previously, HerbalGram included separate tables that reflected

the firms’ different

methods for coding herbal products. (The SPINS-IRI collaboration resulted in a

restatement of previously published 2013 and 2014 sales. Though the data are

identical in most cases, small discrepancies remain, as some of the sales

figures are sometimes modified subsequent to their initial publication.

Year-over-year trends should be referenced within the same published report.)

Horehound was the

top-selling herbal dietary supplement in mainstream outlets for the second year

in a row with sales of $105,880,497 — almost

twice that of the second top-selling herb, cranberry. Traditionally, horehound

has been used as an expectorant and to treat respiratory symptoms, often in the

form of a bitter tea2; today, the herb is commonly found in

multi-herbal combination lozenges (e.g., Ricola®

Natural Herb Cough Drops).

Many popular and well-known botanicals kept their place on 2014’s list of top-selling herbal

supplements in mainstream retail outlets. Ginkgo, garlic, valerian, and milk

thistle ranked among the 20 top-selling herbs; total sales for these

supplements were also some of the least changed from 2013 suggesting their

continued mainstream acceptance.

Several herbs

experienced significant sales increases in 2014. For the first time, ivy leaf

made HerbalGram’s

top-40 list in the mainstream market channel with estimated total sales of

$8,086,029 — a whopping 379% increase from 2013. The German Commission E approved ivy leaf for

the treatment of respiratory inflammation, and the herb has been a popular

component of cough-relieving formulas in Europe for years.3

(According to Pizzorno and Murray’s

Textbook of Natural Medicine,4“more

than 80% of herbal expectorants prescribed in Germany [in 2007] comprised ivy

extract….”) Although the

authors of a 2010 systematic review5 concluded that there was “no

convincing evidence” that ivy leaf is effective for

treating upper respiratory tract infections, at least two recent studies6,7

have suggested that the herb may be beneficial for respiratory conditions in

children under the age of 12. According to SPINS, the ivy leaf product with the

highest mainstream sales in 2014 was, in fact, a pediatric formulation.

In addition to ivy

leaf, three other botanicals were new to 2014’s list of 40 top-selling herbal

supplements in the mainstream channel. Sales of rhodiola, guarana, and grass

(wheat or barley) supplements earned these herbs rankings of 15th, 21st, and

40th, respectively. These products replaced bromelain, artichoke, slippery elm,

and acai, each of which was on 2013’s list of 40 top-selling herbs in this channel.

Coconut oil

continues to enjoy booming sales in the mainstream channel. Mass-market

retailers sold an estimated $9,239,429 of the botanical product in 2014, a

remarkable 210% jump from the previous year. The increased sales were enough to

make coconut oil the 22nd top-selling herb in 2014 in the mainstream channel,

up significantly from its ranking of 40th in 2013. Dr. Mehmet Oz, MD, first

touted the health benefits of this “miracle

fat that fights fat” in 2012 on his daytime television program,8 claiming that the product can help with weight

loss, skin conditions, and ulcers. Rich in saturated fat and medium-chain

triglycerides, coconut oil became even more popular in 2013 when adopters of

the Paleo diet — which encourages the

consumption of so-called “healthy” fats

— embraced the product. In 2014, celebrity endorsements9 of coconut oil for “oil

pulling” (an

Ayurvedic folk tradition in which oil is swished around the mouth to improve

oral and general health) helped increase its visibility once again. Despite popular claims that coconut oil has benefits ranging from teeth-whitening to

heart disease risk reduction, there are few high-quality scientific studies

that support such assertions.10-12

Compared to 2013

data, total mainstream channel sales increased significantly for a number of other herbs including fenugreek (+85%), echinacea (+79%), elderberry (+64%),

and turmeric (+60%). Mainstream echinacea sales in 2014 resulted in the herb

moving from the 8th top-selling herb in 2013 to the 3rd top-selling in 2014;

increased sales of fenugreek bumped the supplement’s ranking from #36 to #28 in the same

time period.

Two

plant-derived compounds saw mainstream sales increases in 2014 as well. Sales

of plant sterols in 2014 increased 33% from the previous year, and bioflavonoid supplement sales increased by 21%. However, sales of isoflavones — the only

other isolated plant compound-based supplement on the list — resulted

in the largest percentage decrease (-29%) of any of the 40 top-selling products

in the mainstream channel.

Other notable sales

declines in 2014 include kelp (-26%), rhodiola (-20%), horsetail (-20%), and

tribulus (-20%).

Sales figures for the categories “Chinese herbs” and “whole food concentrate”

were not included in HerbalGram’s top-40 mainstream channel rankings due to their relative broadness.

Had they remained on the list, Chinese herbs would have been the 2nd top-selling supplement and whole food concentrate would have ranked 39th in

this channel. Individual formulations not primarily derived from botanicals

— such as

biotin, a B vitamin found in some plants, and beta glucans, derived from yeast —

also were

excluded. As the only branded supplement on the list, Relora

® (Next Pharmaceuticals, Salinas, California; purchased by InterHealth Nutraceuticals Inc., Benicia, CA), a proprietary blend of magnolia

(Magnolia officinalis, Magnoliaceae) and phellodendron (Phellodendron

amurense, Rutaceae) bark extracts, was removed as well.

Natural Channel

The natural channel

saw a 5.2% increase to $330,088,019 in estimated total sales over 2013 (Table 5), a healthy yet significantly smaller gain compared to

2013’s 9.9% increase1 and 2012’s impressive 14.7% increase.13

(These data do not include sales from Whole Foods Market, which does not report

its supplement sales to market tracking firms.) Sales in the natural channel tend to come from what marketers call “core

shoppers,” who are committed to a more natural lifestyle, including natural-health modalities.

So-called “peripheral shoppers,” who

have less of a personal commitment to a natural-health philosophy, are more likely to purchase dietary supplements in the mainstream channel.

Consumers in the

natural channel also are showing an increasing interest in issues of

transparency, traceability, and sustainability, often choosing supplements that

are ethically sourced, organically grown or wild-crafted, part of a fair trade

initiative, etc.

After taking the first slot in the natural channel in 2013, turmeric sales remained strong with

an almost 31% increase, totaling $26,288,705 in 2014. This is a continued

increase from 2013, in which turmeric saw 26.2% growth in the natural channel.

Recent research on turmeric and its primary active constituent curcumin

garnered a great amount of attention, with a growing list of purported

benefits. PubMed, the research database run by the National Center for

Biotechnology Information (part of the National Institutes of Health), lists almost

8,000 studies on curcumin as of July 2015.14 Originally gaining

interest for its anti-inflammatory effects as a natural COX-2 inhibitor,

turmeric and curcumin currently are being investigated for their

cancer-fighting properties,15 protection against heavy metal

toxicity,16 and relief of symptoms of depression,17 among

many other potential uses.

The top 20 herbs in the natural channel remained the same from 2013, though some swapped rankings.

Maca and oregano showed high growth at 15.2% and 12.4%, respectively; stevia,

now a popular non-caloric sweetener, saw the largest drop of 12.3%. (Sales of

stevia as a supplement do not reflect sales of stevia as a food product and use

as a sugar alternative; previously, before the FDA approved stevia as a safe food

ingredient, it was sold legally in the United States only as a dietary

supplement.)

Maca’s popularity in 2014 surprised the

Peruvian farmers that cultivate the crop, and increasing demand from both the

United States and China caused the price for fresh and dried maca to skyrocket.

The adaptogenic herb is prized for its use against aging, declining sexual

health, and depression, and allegations of biopiracy and Chinese maca smuggling

has been reported.18 Despite high prices and suspected adulteration,

Peruvian-sourced maca continues to draw consumers.

Oregano supplements, which SPINS defines as oregano essential oil and supplements as

well as oregano leaf tinctures, experienced double-digit growth in 2014.

Marketers claim that oregano supports the immune system and has antifungal,

antibacterial, and antiviral properties. In late September 2014, the FDA issued warning letters to several companies

that made exaggerated and unsubstantiated claims regarding their oregano oils

in regards to the Ebola virus epidemic.19

Direct Sales

In 2014, the direct

sales channel saw a growth of 6.7%, or almost $200 million more than 2013.

Direct channel sales of herbal dietary supplements include multi-level

marketing companies (also known as network marketing companies) such as

Advocare, Herbalife, Nature’s

Sunshine, Nu Skin/Pharmanex, Nutrilite (Amway), Shaklee, USANA, and similar

competitors. This channel also encompasses mail and Internet order sales

companies, direct response TV and radio sales, and sales by health practitioners.

Single vs. Combination Supplements Sales

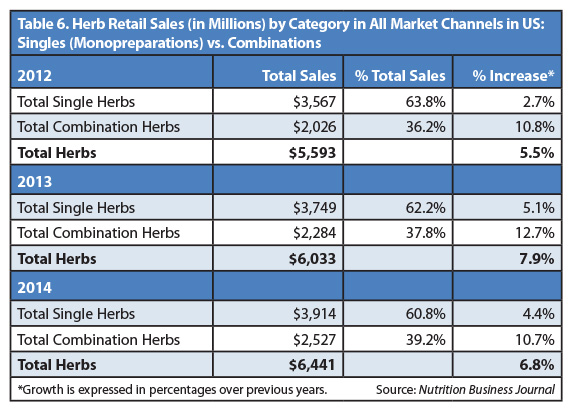

According to NBJ,

sales of single-herb dietary supplements in all channels increased by 4.4%, and

sales of combination formulas rose 10.7% (Table 6). Combination formulas

generally use a blend of herbs that are marketed for a specific benefit,

including maintaining healthy blood sugar and/or blood lipid levels, and easing

the effects of menopause, among others. As shown in Table 6, herbal combination

supplements have been growing in popularity for the past few years, consisting

of 36.2% of total herb sales in 2012 and currently representing 39.2% of sales.

Consumer knowledge of herbs and their benefits continues to become more

sophisticated, and as sales of whole herb preparations maintain their growth, a

more educated population emerges. Consumer awareness of the benefits of whole

herbs versus their isolated constituents may also play a role in the increasing

sales for combination supplements. Herbal blends, such as those used in

traditional Chinese medicine, have a long history of traditional use and modern

research continues to explore their efficacy.20,21

Conclusion

For the 11th consecutive year, American consumers spent more on herbal dietary supplements

than they did in the previous year. Since 2011, estimated herbal supplement

sales in all channels have increased by more than $1 billion; in 2014, US

consumers spent roughly $400 million more on plant-based supplements than in

2013. These figures suggest a clear trend: Americans are continuing to rely on

botanical products for various aspects of their wellbeing and other personal

needs.

The sales data

presented in this report reflect consumer preferences that are similar to those

of previous years. In 2014, retail sales of combination herbal supplements and

total supplement sales in natural and health food stores increased faster than

other herbal supplement products and channels, respectively.

Despite more than a

decade of increased total annual sales of herbal dietary supplements, some

members of the natural products community have expressed concern that 2015

sales could be impacted by recent negative press surrounding herbal products — namely,

the New York Attorney General’s

herbal supplement investigation that began in February 2015.22

However, as detailed in a recent NutraIngredients-USA article,23

SPINS data show that sales of herbal formula (combination) supplements for the 52 weeks ending in mid-July 2015 are up 12.6% from the same period a year

earlier. Interestingly, single-herb supplements have not fared as well. Total

sales, calculated by SPINS in four-week segments, increased for single-herb

products until March 22, but since then, sales of these products have steadily

declined. Still, overall sales of herbal monopreparations in the US remained

fairly constant between mid-July 2014 and mid-July 2015, with a total increase

of just 1.1%.

References

- Lindstrom A, Ooyen C, Lynch ME, Blumenthal M, Kawa K. Sales of herbal dietary supplements increase by 7.9% in 2013, marking a decade of rising sales: turmeric supplements climb to top ranking in natural channel. HerbalGram. 2014:103;52-56. Available at: http://cms.herbalgram.org/herbalgram/issue103/HG103-mkrpt.html. Accessed July 27, 2015.

- Horehound. Drugs.com website. Available at: www.drugs.com/npc/horehound.html. Accessed July 30, 2015.

- Blumenthal M, Goldberg A, Brinckmann J, eds. Herbal Medicine: Expanded Commission E Monographs. Austin, TX: American Botanical Council; Newton, MA: Integrative Medicine Communications; 2000.

- Pizzorno JE, Murray MT. Textbook of Natural Medicine. St. Louis, MO: Churchill Livingstone; 2012. Available at: https://books.google.com/books?id=6cjgo1IixvEC&pg=PA1273&lpg=PA1273&dq=ivy+leaf+popularity&source=bl&ots=zmDrLA9k2c&sig=GV7g1GzvUhLam2Z6osh47YzPrSk&hl=en&sa=X&ved=0CCgQ6AEwAWoVChMIjrXKx9yAxwIVjRuSCh03xgjP#v=onepage&q=ivy%20leaf%20popularity&f=false. Accessed July 30, 2015.

- Holzinger F, Chenot J-F. Systematic Review of Clinical Trials Assessing the Effectiveness of Ivy Leaf (Hedera Helix) for Acute Upper Respiratory Tract Infections. Evidence-Based Complementary and Alternative Medicine. 2011(2011). Available at: www.hindawi.com/journals/ecam/2011/382789/. Accessed July 30, 2015.

- Zeil S, Schwanebeck U, Vogelberg C. Tolerance and effect of an add-on treatment with a cough medicine containing ivy leaves dry extract on lung function in children with bronchial asthma. Phytomedicine. 2014;21(10):1216-20. Available at: www.ncbi.nlm.nih.gov/pubmed/24916707. Accessed July 30, 2015.

- Schmidt M, Thomsen M, Schmidt U. Suitability of ivy extract for the treatment of paediatric cough. Phytother Res. 2012;26(12):1942-7. Available at: www.ncbi.nlm.nih.gov/pubmed/22532491. Accessed July 30, 2015.

- Coconut Oil: The Miracle Fat That Fights Fat, Pt 3. Dr. Oz Show website. Available at: www.doctoroz.com/episode/dr-ozs-miracle-solutions-around-globe?video_id=1942338327001. Accessed July 30, 2015.

- Coconut: Super healthful, or just super trendy? Times Online website. Available at: www.timesonline.com/flavor/coconut-super-healthful-or-just-super-trendy/article_6949d3da-0d20-548e-9322-1db29d178025.html. Accessed July 30, 2015

- Babu AS, Veluswamy SK, Arena R, Guazzi M, Lavie CJ. Virgin coconut oil and its potential cardioprotective effects. Postgraduate Medicine. 2014;126(7):76-83. Available at: www.researchgate.net/publication/265475789_Virgin_Coconut_Oil_and_Its_Potential_Cardioprotective_Effects. Accessed July 30, 2015.

- Coconut Oil: Lose weight? Cure Alzheimer’s? Clog your arteries? Center for Science in the Public Interest website. Available at: www.cspinet.org/nah/articles/coconut-oil.html. Accessed July 30, 2015.

- DebMandal M, Mandal S. Coconut (Cocos nucifera L.: Arecaceae): In health promotion and disease prevention. Asian Pacific Journal of Tropical Medicine. 2011;4(3):241-247. Available at: www.sciencedirect.com/science/article/pii/S1995764511600783. Accessed July 30, 2015.

- Lindstrom A, Ooyen C, Lynch ME, Blumenthal M. Herb Supplement Sales Increase 5.5% in 2012: Herbal Supplement Sales Rise for 9th Consecutive Year; Turmeric Sales Jump 40% in Natural Channel. HerbalGram. 2013:99;60-65. Available at: http://cms.herbalgram.org/herbalgram/issue99/hg99-mktrpt.html. Accessed July 30, 2015.

- “Curcumin” search results. PubMed Database website. Available at: www.ncbi.nlm.nih.gov/pubmed/?term=curcumin. Accessed July 27, 2015.

- “Curcumin cancer”search results. PubMed Database website. Available at: www.ncbi.nlm.nih.gov/pubmed/?term=curcumin%20cancer. Accessed July 27, 2015.

- “Curcumin heavy metal” search results. PubMed Database website. Available at: www.ncbi.nlm.nih.gov/pubmed/?term=curcumin+heavy+metal. Accessed July 27, 2015.

- “Curcumin depression” search results. PubMed Database website. Available at: www.ncbi.nlm.nih.gov/pubmed/?term=curcumin+depression. Accessed July 27, 2015.

- Smith T. Maca madness: Chinese herb smugglers create chaos in the Peruvian Andes. HerbalGram. 2015;105:46-55. Available at: http://cms.herbalgram.org/herbalgram/issue105/hg105-feat-maca.html. Accessed July 27, 2015.

- Smith T. Biopharmaceutical drug produced using tobacco plants may offer hope for Ebola victims. HerbalGram. 2014;104:22-25. Available at: http://cms.herbalgram.org/herbalgram/issue104/HG104-wnews-ebolatobacco.html. Accessed July 27, 2015.

- Wang CY, Bai XY, Wang CH. Traditional Chinese medicine: a treasured natural resource of anticancer drug research and development. Am J Chin Med. 2014;42(3):543-559.

- Wang S, Hu Y, Tan W, et al. Compatibility art of traditional Chinese medicine: from the perspective of herb pairs. J Ethnopharmacol. 2012;143(2):412-23.

- Smith T. The supplement saga: A review of the New York Attorney General’s herbal supplement investigation. HerbalGram. 2015;106:44-55. Available at: http://cms.herbalgram.org/herbalgram/issue106/hg106-FEAT-NYAG.html. Accessed August 6, 2015.

- Daniells S. How are herbal supplement sales post NY AG? Better than last year…. NutraIngredients-USA. August 3, 2015. Available at: www.nutraingredients-usa.com/Markets/How-are-herbal-supplement-sales-post-NY-AG-Better-than-last-year. Accessed August 6, 2015.

|