Issue:

111

Page: 67-73

Sales of Herbal Dietary Supplements in US Increased 7.5% in 2015

Consumers spent $6.92 billion on herbal supplements in 2015, marking the 12th consecutive year of growth

by Tyler Smitha, Kimberly Kawab, Veronica Ecklb, James Johnsonc

HerbalGram.

2016; American Botanical Council

aHerbalGram, American Botanical Council; Austin, Texas

bSPINS; Chicago, Illinois

cNutrition Business Journal, New Hope Natural Media;

Boulder, Colorado

Introduction

Consumer spending on

herbal dietary supplements in the United States reached an all-time high in

2015. Retail sales of herbal supplements totaled an estimated $6.92 billion in

2015 (Table 1), a 7.5% increase in sales from the previous year. Consumers

spent approximately $480 million more on herbal products in 2015 than in the

previous year — an increase that marks the 12th consecutive year of growth for

these products.

These figures, and

the rest of the data* presented in HerbalGram’s 2015 Herb Market Report, were

generously provided by the following organizations: SPINS LLC, a market

research firm based in Chicago, which collaborated with IRI (Information

Resources Inc.), also a Chicago-based market research company, to determine mainstream

multi-outlet retail sales of herbal dietary supplements, and the Nutrition

Business Journal (NBJ), a publication of New Hope Natural Media, a

specialty media company with headquarters in Colorado.

For the seventh year

in a row, sales of herbal supplements increased in each of the three market

channels — mass-market (“mainstream channel”), natural and health food (“natural channel”), and direct sales

(Tables 2 and 3). Although the natural channel generally outperforms the other

two channels in terms of percent growth, in 2015, the mainstream channel

experienced the highest sales increase of 7.9%. Sales growth was slightly less

for the natural (7.7%) and direct sales channels (7.2%).

Mainstream Retail

Channel

Sales of herbal

dietary supplements in the mainstream channel totaled $943 million in 2015, as

determined by SPINS and IRI. This figure represents a 1.5% increase over 2014

sales in this channel of approximately $929 million. NBJ — which includes

convenience store data in its mass-market channel — estimated higher total

mainstream sales of $1.2 billion.

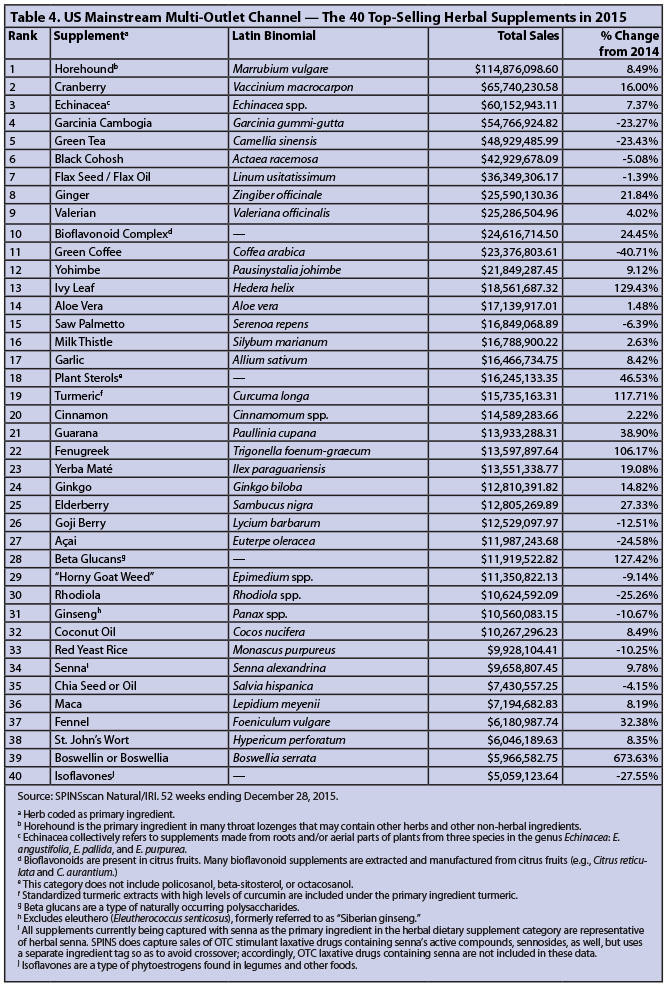

Horehound, for the

third year in a row, was the top-selling herbal supplement in the US mainstream

multi-outlet channel. Sales of horehound supplements in 2015 reached almost

$115 million (see Table 4), an 8.5% increase from the previous year. Since

2013, horehound supplement sales, which include lozenges with horehound as the

primary ingredient, have increased by a total of almost $8 million in

mainstream outlets, indicating strong, continued growth for this member of the

mint (Lamiaceae) family.1

The first documented

medicinal use of horehound was in the 1st century CE, when Roman physician A.

Cornelius Celsus noted that horehound juice could relieve respiratory issues.2

Almost two millennia later, 17th century herbalist Nicholas Culpeper

recommended a horehound syrup preparation “as an excellent help to evacuate tough

phlegm and cold rheum from the lungs of aged persons.”3 Horehound

has also been used to relieve digestive and other issues, but, today, horehound

supplements are still used primarily to support respiratory health.4

Consumers are perhaps more familiar with horehound in the form of cough drops

or lozenges. In recent years, the herb has been revived as an ingredient of

cocktails, particularly the “Rock and Rye,” a classic American whiskey cocktail popular

in the 1930s.5

Boswellia, commonly

known as Indian frankincense, also had a remarkable year in 2015. Although it

ranked 39th on the list of top-selling herbal supplements in the mainstream

channel, the herb experienced a 673.6% increase in sales from the previous

year. Native to parts of India, the Middle East, and northern Africa, the

boswellia tree contains an oily gum resin that can be extracted from the trunk

and made into a highly prized incense. For thousands of years, the resin has

also been used for its anti-inflammatory properties in the traditional Indian

medical system of Ayurveda (see “Natural Channel”

section for more about Ayurveda).6 Today, boswellia supplements are

marketed primarily for their anti-inflammatory properties.7 In

clinical trials, various boswellia preparations have shown promising effects in

subjects with osteoarthritis,8 asthma,9 and colitis10

(an inflammatory condition of the colon).

An article from the

November 30, 2015, issue of The New Yorker described inflammation as the

year’s latest medical “craze,”

noting a significant increase in coverage by both popular news media and

scientific publications. “This explosion in activity has captured the public

imagination,” the article noted.11 “In best-selling books and on

television and radio talk shows, threads of research are woven into cure-all

tales in which inflammation is responsible for nearly every malady, and its

defeat is the secret to health and longevity.”

Boswellia was just

one of the herbal ingredients that benefitted from this “cure-all craze” in 2015. Many

boswellia supplements promoted for their anti-inflammatory actions also are

formulated with turmeric. In 2015, turmeric had the fourth highest percentage

increase in sales (+117.7%) of the mainstream channel’s 40 top-selling herbal

supplements. This yellow-orange spice contains curcumin, which, among many

other properties, is an antioxidant, and which is thought to be responsible, in

part, for turmeric's anti-inflammatory properties. Turmeric and/or curcumin

preparations have been studied for their ability to relieve a number of

inflammation-related conditions, such as rheumatoid arthritis, inflammatory

bowel disease, and various neurodegenerative disorders.12

Other herbal

ingredients in the mainstream channel with greater than 100% increases in sales

in 2015 include ivy leaf (+129.4%), beta glucans (+127.4%), and fenugreek

(+106.2%).

Total sales of ivy

leaf supplements in 2015, particularly as children’s syrups, were more than

double the amount from the previous year. The German Commission E approved ivy

leaf for the treatment of respiratory inflammation, and the herb has been a

popular component of cough-relieving formulas in Europe for years.1

In previous years, HerbalGram has chosen not to

include beta glucans, but it was added back into the data set for 2015 to

reflect the American Botanical Council’s (ABC's) increased coverage of

beneficial fungi and their constituents. Beta glucans are a class of

biologically active compounds that are typically derived from mushrooms,

yeasts, barley, oats, etc. Beta glucans have been studied for their

immune-enhancing and anti-inflammatory properties, among others.13,14

In the top-40 list of the mainstream channel’s bestselling ingredients, several

other herbs known for their immune-enhancing effects also saw increases,

notably elderberry (+27.3%) and echinacea (+7.4%).

Fenugreek

supplements were the fifth product in the mainstream channel that saw a

more-than-100% increase in sales from 2014. The seeds and leaves of the sprouts

are often used in Indian and other cuisines.15 Fenugreek has been

used traditionally to increase breast milk production, for sexual health, to

relieve digestive symptoms, and, more recently, for blood sugar control in

patients with type 2 diabetes.16 In 2015, the results of several

human studies of fenugreek were published, including one that found that a

fenugreek seed extract could increase “sexual arousal and desire” in healthy women,17

and another that suggested an enriched fenugreek seed extract could “enhance testosterone levels and sperm

profiles” in men.18

Mainstream sales of

many well-known herbal supplements, such as the seven originally targeted in

the New York attorney general’s investigation that began in February 2015,

remained fairly stable in 2015. There was a less-than-15% change from 2014

sales for each of the following of these herbs: echinacea (+7.4%), garlic

(+8.4%), ginseng (-10.7%), ginkgo (+14.8%), St. John’s wort (+8.4%), saw

palmetto (-6.4%), and valerian (4.0%).

Green coffee extract

experienced the greatest percentage decrease in mainstream sales from 2014,

with a 40.7% drop in 2015. Although it ranked 11th in overall sales, green

coffee extract was one of numerous weight-loss supplements that experienced

reduced sales in 2015. In the mainstream channel, consumers purchased fewer

green tea (-23.4%) and garcinia (-23.3%) supplements in 2015 than they did in

2014. Notably, beginning in 2012, each of these three products has been

promoted by Mehmet Oz, MD, on his daytime talk show “The Dr. Oz Show.”19 In a

widely publicized hearing of the US Senate Subcommittee on Consumer Protection,

Product Safety, and Insurance in June 2014, Senator Claire McCaskill (D-MO)

criticized the evidence supporting these popular weight-loss products. Since

that time, the “Dr.

Oz Effect” that once boosted sales of these herbs has diminished significantly.

Still, garcinia and green tea ranked fourth and fifth, respectively, in terms

of overall 2015 sales in the mainstream channel.

Other herbal

ingredients in the mainstream channel that saw significant percentage sales

decreases in 2015 include isoflavones (-27.6%), rhodiola (-25.3%), and acai

(-24.6%). Sales of rhodiola, an herb with clinically supported cognitive health

benefits,20 may have been impacted by another Senate hearing led by

McCaskill. In July 2015, she chaired a subcommittee hearing on dietary

supplement products that claim “to provide protection against Alzheimer’s, dementia,

stroke, memory loss and cognitive decline.”21 Although rhodiola

supplements were not implicated in the hearing,22 their decline in

sales may reflect consumers distancing themselves from this product category in

the second half of 2015, although this potential association is difficult to

establish with any certainty.

In addition,

researchers at the University of Illinois Urbana-Champaign published mixed

findings in April 2015 related to soy (Glycine max, Fabaceae)

consumption and cancer.23 Their negative findings surrounding

purified isoflavones may partially explain the drop in sales for this

ingredient, which is typically derived from soy.

Finally, acai’s

diminished sales in 2015 — its third consecutive year of reduced sales — may,

in part, be due to the proliferation of new “superfoods” rising to take its place.24

Sales figures for

the categories “Chinese herbs”

and “whole food

concentrate” were not included in HerbalGram’s top-40 mainstream channel rankings

due to their relative broadness. Had they remained on the list, Chinese herbs

would have been the second top-selling supplement (with a 10% decline in sales

from 2014) and whole food concentrate would have ranked 43rd in this channel

(with an 11% sales decline from 2014). Individual formulations not primarily

derived from botanicals — such as biotin (a B vitamin found in some plants) and

blue-green algae (a type of cyanobacteria) — also were excluded. As the only

branded supplement on the list, Relora (InterHealth Nutraceuticals Inc.;

Benicia, California), a proprietary blend of magnolia (Magnolia officinalis,

Magnoliaceae) and phellodendron (Phellodendron amurense, Rutaceae) bark extracts,

was removed as well.

Natural Channel

The natural channel

saw a 4% increase in sales in 2015, with a total of $365 million spent on

herbal supplements (Table 5), according to SPINS. This increase is slightly

smaller than 2014’s 5.2% increase1 and 2013’s significant 9.9% increase in sales.25

Sales in the natural channel tend to come from what marketers call “core shoppers,” who are committed to a

more natural lifestyle, including natural-health modalities. So-called “peripheral shoppers,” who have less of

a personal commitment to a natural-health philosophy, are more likely to

purchase dietary supplements in the mainstream channel.

For the third year

in a row, turmeric was the top-selling herbal dietary supplement in the natural

channel in 2015, with total sales of $37,334,821. It also had the

second-highest percentage sales growth (+32.2%) over the previous year’s sales.

Ashwagandha

experienced the highest percentage growth in the natural channel; sales of this

traditional Indian herb in 2015 were 40.9% higher than they were in 2014.

Ashwagandha has been used in the Ayurvedic system of medicine for thousands of

years for a variety of purposes: to reduce stress, combat fatigue, strengthen

the immune system, reduce inflammation, and boost cognition, among many others.26

Ashwagandha sales likely benefitted from a number of positive studies published

at the end of 2014 and during 2015 that supported some of these traditional

uses. Published in December 2014, a systematic review and meta-analysis of five

randomized clinical trials of ashwagandha for anxiety concluded that subjects

taking the herb had “greater

score improvements (significantly in most cases) than placebo in outcomes on

anxiety or stress scales.”27 In addition, an eight-week randomized

controlled trial published in December 2015 found that an ashwagandha root

extract increased strength and muscle mass in 57 males undergoing resistance

training.28 In vivo and in vitro studies published in 2015 suggested

ashwagandha’s potential use in conditions ranging from Alzheimer’s disease29

to cancer.30

The popularity of

turmeric and ashwagandha in the natural channel — as well as boswellia’s 674%

sales increase in the mainstream channel — reflects a broader trend in herbal

dietary supplements in 2015: increased consumer familiarity with and acceptance

of Ayurvedic herbs. These herbal ingredients, which have been used for

millennia in India, have been formulated in a range of products, from herbal

supplements to cosmetics.

Garcinia and chia

seed/oil had the only two significant percentage sales drops in the natural

channel in 2015. Garcinia sales in 2015 were 47.9% less than sales in 2014.

Chia sales during the same period dropped 33.0%. This was the second

consecutive year with reduced sales for chia; in 2014, chia sales had declined

1.2% from 2013 sales. Like acai in the mainstream channel, chia sales may have

declined, in part, due to an oversaturation of newly-hyped superfoods (e.g.,

hemp, kelp, and matcha powder).31 Furthermore, in January 2015, the

Centers for Disease Control and Prevention linked a salmonella outbreak that

sickened 31 people in the US to organic chia seed powder;32 chia was

again linked to a salmonella outbreak, this time in Canada, in December 2015.33

Both incidences may have impacted sales. In addition, one small human study

published in May 2015 found that chia seed oil had no positive impact on

distance runners,34

but an association of this study with chia sales declines cannot be made.

Direct Sales Channel

In 2015, direct

sales of herbal supplements in the US increased by 7.2% to a total of more than

$3.36 billion, according to NBJ. Growth in this channel was slightly more

pronounced than the 6.4% sales increase in 2014 from the year before. Direct

channel sales of herbal dietary supplements include multi-level marketing

companies (also known as network marketing companies). This channel also

encompasses mail and internet order sales companies, direct response TV and

radio sales, and sales by health practitioners.

Single vs.

Combination Herb Supplements

Overall, total sales

of single-herb supplements (monopreparations) were higher than those of

combination herb supplements in 2015, but combination products outpaced

single-herb products in terms of sales growth, according to NBJ (see Table 6).

Combination supplement sales in all channels grew 10.7% compared to the

previous year, and sales of monopreparations increased by 5.5% from 2014.

Combination herbal supplements have outpaced single-herb supplements in terms

of percentage sales growth since 2011.

Combination formulas

generally use a blend of herbs that are marketed for a specific benefit,

including maintaining healthy blood sugar and/or blood lipid levels, and easing

the effects of menopause, among many others. Herbal blends, such as those used

in traditional Chinese medicine, have a long history of traditional use, and

modern research continues to explore their efficacy.

Conclusion

In a period of just

three years, from 2012 to 2015, total annual retail sales of herbal supplements

increased by more than $1.3 billion. Despite frequent negative media coverage

of herbal dietary supplements in 2015, including coverage of the New York

attorney general’s investigation,35 the crackdown on illegal drugs

masquerading as “dietary

supplements” by federal agencies in November, and some publications associating

some products with potential adverse health effects36 — total sales

of the entire herbal dietary supplement category remained strong. In fact, 2015’s

7.5% increase in overall sales represents the second highest percentage growth

for these products in more than a decade.

References

- Smith T, Lynch ME, Johnson J, Kawa K,

Bauman H, Blumenthal M. Herbal dietary supplement sales in US increase 6.8% in

2014. HerbalGram. 2015;107:52-59. Available at: http://cms.herbalgram.org/herbalgram/issue107/hg107-mktrpt-2014hmr.html.

Accessed August 10, 2016.

- Horehound herb. Natural Remedies website.

Available at: www.naturalremedies.org/horehound/. Accessed August 10, 2016.

- White horehound. A Modern Herbal website.

Available at: www.botanical.com/botanical/mgmh/h/horwhi33.html. Accessed

August 10, 2016.

- White horehound. WebMD website. Available at:

www.webmd.com/vitamins-supplements/ingredientmono-886-white%20horehound.aspx?activeingredientid=886&activeingredientname=white%20horehound.

Accessed August 10, 2016.

- Newman K. Rock and Rye: Good Medicine.

November 26, 2012. Available at:

www.saveur.com/article/Wine-and-Drink/Rock-and-Rye-Cocktail-History. Accessed August 10, 2016.

- Siddiqui MZ. Boswellia serrata, A Potential

Anti-inflammatory Agent:

- Boswellia. Memorial Sloan Kettering Cancer

Center website. June 17, 2016. Available at:

www.mskcc.org/cancer-care/integrative-medicine/herbs/boswellia. Accessed August

10, 2016.

- Sengupta K, Alluri KV, Satish AR, et al. A

double blind, randomized, placebo-controlled study of the efficacy and safety

of 5-Loxin for treatment of osteoarthritis of the knee. Arthritis

Res Ther. 2008;10(4):R85. doi: 10.1186/ar2461.

- Gupta I, Gupta V, Parihar A, et al.

Effects of Boswellia serrata gum resin in patients with bronchial asthma: results of a double-blind, placebo-controlled, 6-week clinical study. Eur J Med Res. 1998;3(11):511-4. Available at: www.ncbi.nlm.nih.gov/pubmed/9810030. Accessed August 10, 2016.

- Madisch A, Miehlke S, Eichele O, et al. Boswellia serrata extract for the treatment of collagenous colitis. A double-blind, randomized, placebo-controlled, multicenter trial. Int J Colorectal Dis. 2007;22(12):1445-51. Available at: www.ncbi.nlm.nih.gov/pubmed/17764013. Accessed August 10, 2016.

- Groopman J. Inflamed: The debate over the latest cure-all craze. The New Yorker. November 30, 2015. Available at: www.newyorker.com/magazine/2015/11/30/inflamed. Accessed August 10, 2016.

- Gupta

SC, Patchva S, Aggarwal B. Therapeutic Roles of Curcumin: Lessons Learned from

Clinical Trials. AAPS J. 2013;15(1):195-218. doi: 10.1208/s12248-012-9432-8.

- Rop O, Mlcek J, Jurikova T. Beta-glucans in higher fungi and their health effects. Nutr Rev. 2009;67(11):624-31. doi: 10.1111/j.1753-4887.2009.00230.x.

- Zhu F, Du B, Xu B. A critical review on production and industrial applications of beta-glucans. Food Hydrocolloids. 2016;52:275-288. doi:

10.1016/j.foodhyd.2015.07.003.

- Coles T. Fenugreek Benefits And Everything Else You Need To Know About This Seed. Huffington Post Canada website. June 25, 2015. Available at:

www.huffingtonpost.ca/2015/06/25/fenugreek-benefits_n_7665686.html. Accessed

August 10, 2016.

- Bahmani M, Shirzad H, Mirhosseini M, Mesripour A, Rafieian-Kopaei M. A review on ethnobotanical and therapeutic uses of fenugreek (Trigonella foenum-graceum L). J Evid Based Complementary Altern Med. 2016 Jan;21(1):53-62.

Available at: www.ncbi.nlm.nih.gov/pubmed/25922446. Accessed August 10, 2016.

- Rao A, Steels E, Beccaria G, Inder WJ, Vitetta L. Influence of a specialized Trigonella foenum-graecum seed extract (Libifem), on testosterone, estradiol and sexual function in healthy menstruating women, a randomised placebo controlled study. Phytother Res. April 2015;29(8):1123-1130. Available at:

http://onlinelibrary.wiley.com/doi/10.1002/ptr.5355/abstract. Accessed August

10, 2016.

- Can Fenugreek Seed Extract Help Raise Testosterone Levels? Nutritional Outlook

website. November 18, 2015. Available at: www.nutritionaloutlook.com/herbs-botanicals/can-fenugreek-seed-extract-help-raise-testosterone-levels. Accessed August 10, 2016.

- Smith T. Dr. Oz’s “miracle” herbal weight-loss products: the Senate hearing, advertising regulations, and science behind the claims. HerbalGram. 2014;103:57-61. Available at: http://cms.herbalgram.org/herbalgram/issue103/HG103-legreg-droz.html. Accessed August 10, 2016.

- Rhodiola. WebMD website. Available at:

www.webmd.com/vitamins-supplements/ingredientmono-883-rhodiola.aspx?activeingredientid=883. Accessed August 10, 2016.

- O’Connor A. Alzheimer’s Supplements

Targeted by U.S. Senator. The New York Times. June 19, 2015. Available

at: http://well.blogs.nytimes.com/2015/06/19/alzheimers-supplements-targeted-by-u-s-senator/?_r=0. Accessed August 10, 2016.

- Perrone M. Senator McCaskill Questions Retailers, Search Engines about Supplements Targeting Seniors. U.S. News and World Report. June 17, 2015. Available at: www.usnews.com/news/business/articles/2015/06/17/senator-probes-retailers-on-dubious-brain-supplements.

Accessed August 10, 2016.

- University of Illinois at Urbana-Champaign. Gene mapping reveals soy’s dynamic, differing roles in breast cancer.ScienceDaily. April 28, 2015.Available at:

www.sciencedaily.com/releases/2015/04/150428171406.htm. Accessed August 10, 2016.

- The Glow Team. Forget Kale — These Are the Superfood Trends Coming Your Way in

2015. Mama Mia website. January 9, 2015. Available at: www.mamamia.com.au/superfoods-2015/. Accessed August 10, 2016.

- Lindstrom

A, Ooyen C, Lynch ME, Blumenthal M, Kawa K. Sales of herbal dietary supplements

increase by 7.9% in 2013, marking a decade of rising sales: turmeric

supplements climb to top ranking in natural channel. HerbalGram. 2014;103:52-56. Available at: http://cms.herbalgram.org/herbalgram/issue103/HG103-mkrpt.html. Accessed August 10, 2016.

- Singh N, Bhalla M, de Jager P, Gilca M. An overview on ashwagandha: a rasayana

(rejuvenator) of Ayurveda. Afr J Tradit Complement Altern Med. 2011;8(5

Suppl):208-213. Available at: http://www.ncbi.nlm.nih.gov/pmc/articles/PMC3252722/. Accessed August 10, 2016.

- Pratte MA, Nanavati KB, Young V, Morley CP. An alternative treatment for anxiety: a systematic review of human trial results reported for the Ayurvedic herb

ashwagandha (Withania somnifera). J Altern Complement Med. December

2014;20(12):901-908. Available at: http://www.ncbi.nlm.nih.gov/pubmed/25405876. Accessed August 10, 2016.

- Oliff H. Ashwagandha improves muscle strength and recovery in men performing

resistance training. HerbalGram. 2016;110:41-42. Available at:

http://cms.herbalgram.org/herbalgram/issue110/hg110-resrvw-ashwa.html. Accessed August 10, 2016.

- Michigan State University. Promising ‘natural’ Alzheimer’s

treatment moves toward clinical trials. ScienceDaily. March 11, 2015.

Available at: www.sciencedaily.com/releases/2015/03/150311124643.htm. Accessed August 10, 2016.

- Halder B, Singh S, Thakur SS, Pizzo SV. Withania

somnifera root extract has potent cytotoxic effect against human

malignant melanoma cells. PLoS One. 2015;10(9):e0137498. Available at: www.ncbi.nlm.nih.gov/pmc/articles/PMC4559428/. Accessed August 10, 2016.

- Frank J. Over Kale? Here Are the New Superfoods of 2015. Vogue Australia. December 18, 2014. Available at: www.vogue.com.au/beauty/wellbeing/over+kaler+here+are+the+new+superfoods+of+2015,34855. Accessed August 10, 2016.

- Falkenstein D. Chia Seed Powder Salmonella Outbreak Sickened Nearly 100. Food Poison Journal website. January 18, 2015. Available at: www.foodpoisonjournal.com/foodborne-illness-outbreaks/chia-seed-salmonella-outbreak-sickened-nearly-100/#.V6tB1I6T79V. Accessed August 10, 2016.

- Larsen L. Chia Seeds Recalled in Canada for Possible Salmonella. Food Poisoning

Bulletin website. December 9, 2015. Available at: https://foodpoisoningbulletin.com/2015/chia-seeds-recalled-in-canada-for-possible-salmonella/. Accessed August 10, 2016.

- Nieman DC, Gillitt ND, Meaney MP, Dew DA. No positive influence of ingesting chia seed oil on human running performance. Nutrients. May 2015;7(5):3666-3676. Available at: www.ncbi.nlm.nih.gov/pmc/articles/PMC4446772/. Accessed August 10, 2016.

- Smith T. The supplement saga: a review of the New York Attorney General’s herbal supplement investigation. HerbalGram. 2015;106:44-55. Available at:

http://cms.herbalgram.org/herbalgram/issue106/hg106-FEAT-NYAG.html. Accessed August 10, 2016.

- Daniells S. The 10 Key Events of 2015…Our Editors’ Selection. NutraIngredients-USA website. December 15, 2015. Available at: http://www.nutraingredients-usa.com/Markets/The-10-key-events-of-2015-Our-Editors-selection/.

Accessed August 10, 2016.

|