Issue:

115

Page: 56-65

Herbal Supplement Sales in US Increase 7.7% in 2016

Consumer preferences shifting toward ingredients with general wellness benefits, driving growth of adaptogens and digestive health products

by Tyler Smith, Kimberly Kawa, Veronica Eckl, Claire Morton , Ryan Stredney

HerbalGram.

2017; American Botanical Council

PDF available here PDF available here

Introduction

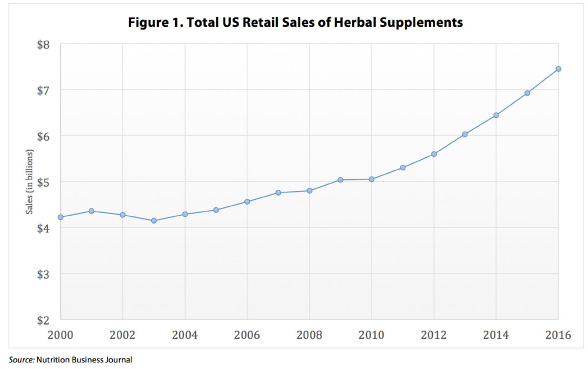

Total sales of herbal dietary supplements in

the United States increased by 7.7% in 2016 — the second highest rate of growth

for these products in more than a decade. Consumers spent an estimated $7.452

billion on herbal supplements in 2016, an increase of approximately $530

million from 2015 (Table 1). This marks the 13th consecutive year of overall

sales growth for herbal supplements and the first time that total US retail

sales of these products have surpassed $7 billion.

The information presented in this report is based on retail sales data

provided by three organizations: the market research firms SPINS and IRI, both

based in Chicago, Illinois, and Nutrition Business Journal (NBJ), part

of the New Hope Network (now part of Informa), a natural products

industry-focused media company based in Boulder, Colorado. SPINS collaborated

with IRI to determine total retail sales of herbal dietary supplements in the

mainstream multi-outlet retail channel. NBJ calculated total overall sales of

herbal supplements as well as breakdowns by market channel and product type

(single-herb vs. combination-herb supplements). The figures in this report

reflect the most current estimates (as of July 2017) for herbal dietary

supplement sales during the 52-week period that ended January 1, 2017.

In addition to the 7.7% increase in total sales of herbal supplements in

2016, retail sales increased for the eighth consecutive year in each of the

three primary market channels, as defined by NBJ (Tables 2 and 3). Mass-market

sales of herbal supplements in 2016 totaled an estimated $1.336 billion — an

11% increase over 2015 sales in this channel. Sales of herbal supplements in

natural and health food retail stores increased by 6.4% from the previous year

to a total of $2.506 billion in 2016. Direct-to-consumer sales of herbal

supplements also increased substantially, with a total of $3.609 billion in

sales in 2016, a 7.3% increase from 2015.

The SPINS/IRI sales data for individual herbs discussed in this report,

and those listed in Tables 4 and 5, reflect sales of dietary supplements in

which that herb is the primary ingredient. This includes only products that

meet the legal definition of a dietary supplement, per the US Food and Drug

Administration.1

Mainstream Channel

SPINS, which does not include convenience store sales in its mainstream

retail channel, determined total mainstream multi-outlet sales of herbal

supplements to be approximately $943.9 million in 2016. Compared to NBJ’s

mass-market channel calculations, this represents a significantly less robust

increase of 0.1% in mainstream herbal supplement sales in 2016.*

For the fourth consecutive year, horehound (Marrubium vulgare,

Lamiaceae) was the top-selling herbal supplement in mainstream retail outlets

in the United States. Sales of horehound supplements, which include cough drops

and lozenges with horehound as the primary ingredient, totaled $125,468,033 in

2016. This is approximately $10.7 million, or 9.3%, more than was spent on

these products in 2015.

A member of the mint family, horehound has been used as a medicine since

ancient times. One of the first recorded uses of horehound dates back to the

first century, when a Roman physician described using the juice of the herb to

treat respiratory conditions.2 Human clinical trials of horehound

for respiratory conditions are limited, but the herb’s expectorant and

cough-suppressant properties make it a useful addition to natural cough drops

and lozenges.3

Wheatgrass (Triticum aestivum, Poaceae) and barley (Hordeum

vulgare, Poaceae) experienced the strongest mainstream sales growth in 2016

with a 131.9% increase in sales from 2015. SPINS, which groups these two

members of the grass family as a single item in its data set, reported total

mainstream sales of $5,770,618 for these ingredients in 2016, making them the

38th top-selling herbal supplement in this channel.

Both barley and wheatgrass, the name commonly used for the young leaves,

or cotyledons, of the wheat plant, contain a variety of vitamins, minerals, and

phytochemicals (e.g., flavonoids and chlorophyll).4,5 Wheatgrass has

been promoted for a wide range of potential health benefits, including

detoxification, digestive and immune support, and improved energy.6

Barley has been marketed for cardiovascular and digestive health, improved

strength, and other benefits.7 The significant sales increase for

these ingredients may reflect broader consumer trends toward whole-food

supplements and products that promote general wellness.8 In its 2016

Annual Survey on Dietary Supplements, the Council for Responsible Nutrition

(CRN), a natural products industry trade association, reported “overall

health/wellness benefits” as the number one reason why consumers take dietary

supplements.9

“Condition-specific supplements have long been the cornerstone of [health

and beauty departments]…. But the new way forward isn’t predicated on any

single health condition,” noted an October 2016 article from Natural Foods

Merchandiser, a New Hope Network publication.8 “Rather, it

focuses on supplements that support whole-body health.”

The nutrient

density of wheatgrass and barley has earned them a reputation as so-called

“superfoods.” These grasses are available in various forms, including as

juices, capsules, and powders, as well as in combination products marketed as

“supergreens” (a term that refers to various nutrient-rich leafy greens) that

are used to boost the nutritional content of smoothies and other beverages.

According to CRN’s 2016 survey, “filling in nutrient gaps in the diet” was the

third most common reason for consumers to take supplements.9

Suffering from “pill fatigue,” health-conscious consumers have turned to these

easy-to-consume sources of nutrition that can be incorporated into beverages.

As such, wheatgrass and barley sales likely were impacted by the “green

beverage” trend that took hold in 2016.10

Three other

ingredients experienced mainstream sales increases of more than 50% in 2016:

boswellia (Boswellia serrata, Burseraceae; +118.7%), turmeric (Curcuma

longa, Zingiberaceae; +85.5%), and fenugreek (Trigonella foenum-graecum,

Fabaceae; +52.1%). This growth is less pronounced than the sales increases seen

in 2015, in which mainstream sales for each of these herbs more than doubled

from 2014. (Sales of boswellia, for example, increased by a remarkable 673.6%

from 2014 to 2015.) Boswellia, turmeric, and fenugreek have been used

traditionally in Ayurveda, an ancient system of medicine in India that has

become increasingly well-known to consumers in the West.11,12 The

continued popularity of these ingredients in 2016 may be due in part to the

growing consumer awareness of Ayurvedic herbs.13

Bioflavonoid

complex, the 29th top-selling herbal supplement in the mainstream channel in

2016, experienced a 58.8% decrease in sales from 2015 — the largest sales

decline of any of the top 40 herbs in the mainstream channel. Bioflavonoids are

a group of phytochemicals that have been studied for a range of potential

health benefits. These compounds have been shown to increase vitamin C

absorption, and researchers have examined their ability to lower cholesterol,

promote circulation, and reduce inflammation.14 In 2015,

bioflavonoid complex was the 10th top-selling herbal supplement in this

channel, and it experienced a 24.5% increase in mainstream sales from 2014 to

2015. The reasons for the sharp decline in sales in 2016 are unclear, but they

may be related to consumer preferences for easily recognizable ingredients that

promote general wellness.10 According to SPINS, some of the

top-selling bioflavonoid products included in the 2016 data set were marketed

for specific health conditions, which likely limited their general appeal.

With a 54.3%

decline in sales from 2015 to 2016, goji berry (Lycium barbarum and L.

chinense, Solanaceae) was the only other herbal ingredient with a decrease

of more than 50% in mainstream sales during this period. Goji berry dropped

from the 26th top-selling supplement in 2015 to the 39th in 2016. Goji berry,

also known as Chinese wolfberry, is popularly regarded as a superfood. Goji

berry’s sales decline may be due in part to its steep price and the

proliferation of new superfoods, as noted in HerbalGram’s 2015 Herb

Market Report.15 An article published in The Wall Street

Journal in January 2016 summarized the declining interest in goji berry in

its opening sentence, noting that “Some food trends fade faster than you can

say ‘goji berry.’”16 Fox News also mentioned the fruit in a

December 2016 article titled “2016 food trends we’re so over....”17

It appears that

US consumers have continued to distance themselves from certain herbs with

alleged weight-loss or metabolism-boosting benefits in 2016.18-21

This was reflected in mainstream sales declines for green coffee (Coffea

arabica, Rubiaceae) extract (–40.6%), which had the third highest percent

sales decrease from 2015; yerba mate (Ilex paraguariensis,

Aquifoliaceae; –36.5%), which had the fourth highest percent sales decline; and

garcinia (Garcinia gummi-gutta, Clusiaceae; –29.6%), which experienced

the sixth highest percent sales decline. However, in 2016, boosting energy

remained the second most common reason for taking supplements, according to

CRN’s annual survey.9 As an alternative to these ingredients,

consumers may be turning to a different class of herbs: the adaptogens, which,

as discussed later, have been shown to have many effects on the body, including

an impact on energy levels.22

As in previous

years, HerbalGram chose to exclude certain ingredients from SPINS and

IRI’s tally of the 40 top-selling herbal supplements in the US mainstream

retail channel. As the only branded supplement on the list, Relora (InterHealth Nutraceuticals Inc.; Benicia,

California), a proprietary blend of magnolia (Magnolia

officinalis,

Magnoliaceae) and phellodendron (Phellodendron amurense, Rutaceae) bark extracts, was not included in this

year’s report. Had it been included, Relora would have been the 38th

top-selling supplement in the mainstream channel in 2016, despite its 46.7%

decline in sales from 2015. Menthol, which would have ranked 15th in the 2016

mainstream channel, was the only other excluded ingredient. Although menthol

can be naturally derived from mint (Mentha spp., Lamiaceae) species,

much of the supply is now produced synthetically,23

and therefore is not considered by ABC to be an “herb.”

Natural Channel

Retail sales of

herbal supplements in the US natural channel totaled $382,955,108 in 2016, a

4.89% increase from 2015, according to estimates from SPINS. This is

substantially less than NBJ’s estimated total of $2.506 billion for its natural

market channel, which also includes sales from independent retailers and other

large retailers, such as Whole Foods Market. Sales in the natural channel tend

to come from what marketers call “core

shoppers,” who are committed to a natural lifestyle. So-called “peripheral shoppers,” who have less of a

personal commitment to a natural-health philosophy, are more likely to purchase

dietary supplements in the mainstream channel.

Turmeric was the

top-selling herbal supplement in natural retail stores for the fourth

consecutive year with sales of $47,654,008 in 2016. Sales of turmeric in

natural retail stores increased by more than $11.5 million from 2015. This 32%

increase in sales was the third highest percent sales increase of any of the 40

top-selling herbs in this channel.

The popularity of

turmeric has been increasing steadily in recent years, but consumer interest in

this yellow-gold spice spiked in 2016.24 Based on an analysis of

search engine queries, Google classified turmeric as the “breakout star” of the

functional food movement of the past five years. During that time, Google

searches for turmeric increased by 300%.25

Ashwagandha (Withania

somnifera, Solanaceae), the eighth top-selling herbal supplement in the

natural channel, had the largest percent sales growth in 2016, with a 55.2%

increase from 2015. Ashwagandha’s popularity may be due in part to growing

consumer awareness of two natural product trends: Ayurvedic herbs, as discussed

previously, and adaptogens.8 Natural channel shoppers, who tend to

follow developments pertaining to natural ingredients more closely than

peripheral shoppers, are perhaps more likely to have been familiar with these

trends in 2016.

Adaptogenic

herbs, sometimes referred to as “superherbs,”26 were listed among

2016’s top health and wellness trends by many major media outlets.27,28

The term “adaptogen” first appeared in the scientific literature in the late

1950s, when it was loosely defined as any substance that promoted “non-specific

resistance” to stress.29 (Subsequent publications have honed in on

more specific physiological responses, but the term is still somewhat

ambiguously defined.) In general, adaptogens are non-toxic substances that

promote the normalization of bodily functions and support a healthy response

and resistance to “noxious factors” or stressors. Several other ingredients

with adaptogenic properties experienced natural channel sales growth in 2016,

including mushrooms (+13.8%), “ginseng” (Panax spp., Araliaceae; +9.3%),

rhodiola (Rhodiola spp., Crassulaceae; +5.5%), and holy basil (Ocimum

tenuiflorum, Lamiaceae; +2.8%).

The top-selling

herbal ingredients in the 2016 natural channel were the same as those that made

the top-40 list in 2015, with one exception: dandelion (Taraxacum officinale,

Asteraceae). Natural channel sales of dandelion in 2016 totaled $2,520,049, a 15.4%

increase from 2015. (Dandelion, which came in as the 38th top-selling herb in

2016, displaced St. John’s wort [Hypericum perforatum, Hypericaceae]

from the list.) Although dandelion may be better known as a weed, preparations

of the root30,31 have been used for millennia as a medicine for

liver and kidney diseases, upset stomach, and heartburn, among other

conditions.32 As an ingredient in herbal dietary supplements,

dandelion is commonly found in teas marketed for detoxification, weight loss,

digestive health, and stimulation of urine flow and appetite.33

Dandelion30

is one of several herbal ingredients with bitter properties to make the list of

top-selling herbal ingredients in 2016. Other herbs include green tea (Camellia

sinensis, Theaceae; +8.5%), aloe (Aloe vera, Xanthorrhoeaceae)

+6.6%), echinacea (Echinacea spp., Asteraceae; +6.3%), burdock (Arctium

lappa, Asteraceae; +4.8%), and milk thistle (Silybum marianum,

Asteraceae; +2.1%).34 Bitterness as a flavor also ranked among the

food and beverage trends of 2016. Herbs, including some of the previously

discussed leafy greens, produce a wide variety of compounds that humans

perceive as bitter-tasting. The consumption of certain bitter phytochemicals

has been linked to a wide range of health benefits, but the compounds are

perhaps most closely associated with digestion. The scientific explanation

behind this relationship is well established. “As most naturally

occurring bitter tasting stimuli are toxins at some concentration,

the body responds to strong bitter tastes as if toxins are about to

be ingested,” explained the authors of a 2013 review article.35 As

part of the body’s first line of defense, the gastrointestinal system responds

by attempting to limit the impact of the potential toxin.

Emerging research

on the “gut-brain connection” and the importance of intestinal microbiota to

overall health has likely fueled consumer interest in bitter and digestive

health products.36 However, according to some sources, consumers are

still buying digestive health products primarily to address specific issues,

such as constipation and diarrhea. “While these reactive digestive issues are

the main reason for using these types of products, there are many opportunities

for category expansion based on a prevention platform,” a 2016 “Mind of the

Consumer” report by Natural Products INSIDER noted.37 “Within

this white space are conditions such as immunity, mental focus, weight loss,

energy and joint issues — all of which can be linked back to digestive health.”

Direct Sales

Direct sales of herbal supplements totaled $3.609 billion in 2016, a

7.3% increase from 2015 sales in this channel, according to NBJ. This is the

highest percentage increase in direct sales of herbal supplements in more than

a decade, according to previous HerbalGram herb market reports. Direct

channel sales of herbal dietary supplements include multilevel marketing

companies (also known as network marketing companies). This channel also encompasses

mail- and internet-order sales companies, direct-response TV and radio sales,

and sales by health practitioners.

According to a NutraIngredients-USA article from October 2016: “Network

marketing continues to be a huge outlet for nutritional products, and direct

selling companies with supplements in their portfolios are among the best

performing of these companies.”38

Single-Herb vs.

Combination-Herb Supplements

Since 2011, sales growth of combination-herb supplements has outpaced

that of single-herb supplements, and this trend continued in 2016.

Combination-herb supplement sales in all channels grew 10.1% from 2015, and

single-herb supplement sales increased by 6.1%. However, as noted in Table 6,

total sales of single-herb supplements were higher overall than sales of

combination-herb supplements in 2016, according to NBJ.

Conclusion

2016 marked the

13th consecutive year of overall sales growth for herbal supplements and the

eighth year of increased sales in each of the three market channels. This

suggests that consumers — from casual shoppers in mainstream retail outlets to

core consumers of natural products — are continuing to turn to plant- and

fungi-based options for their health care and self-care.

The shifts in

sales of certain ingredients in 2016 point to the evolving preferences and

priorities of consumers. Although shoppers are still buying supplements to

address specific health concerns, increased sales for herbal ingredients

marketed for overall wellness and vitality suggest that some are taking a more

proactive, holistic approach to wellness. In particular, sales of adaptogenic

herbs, a category of plants with broad and appealing effects, seem to have

benefited from this trend. As scientific research continues to explore the

connection between the digestive system and overall health, the rise of bitter

herbs and other products marketed for gastrointestinal health may also be a

component of this “systemic wellness” trend.

References

- FDA

basics: What is a dietary supplement? US Food & Drug Administration

website. Available at: www.fda.gov/aboutfda/transparency/basics/ucm195635.htm. Accessed July 19,

2017.

- Horehound

herb. Natural Remedies website. Available at: www.naturalremedies.org/horehound/. Accessed July 19,

2017.

- Horehound.

University of Michigan Medicine website. Available at: www.uofmhealth.org/health-library/hn-2109003. Accessed July 19,

2017.

- What

are the benefits of wheatgrass? Mercola website. Available at: http://articles.mercola.com/herbs-spices/wheatgrass.aspx. Accessed July 19,

2017.

- Barley

grass. Drugs.com website. Available at: href="www.drugs.com/npc/barley-grass.html. Accessed July 19,

2017.

- Wheatgrass

benefits: 11 reasons to enjoy. Healthline website. Available at: www.healthline.com/health/food-nutrition/wheatgrass-benefits#superfood2. Accessed July 19,

2017.

- Barley.

WebMD website. Available at: www.webmd.com/vitamins-supplements/ingredientmono-799-barley.aspx?activeingredientid=799&activeingredientname=barley. Accessed July 19, 2017.

- Runestad

T. Supplement Trendspotting. October 24, 2016. Natural Foods Merchandiser.

Available at: www.newhope.com/vitamins-and-supplements/supplement-trendspotting. Accessed July 19, 2017.

- Consumer

data: CRN 2016 Annual Survey on Dietary Supplements. Council for Responsible

Nutrition website. Available at: www.crnusa.org/resources/crn-2016-annual-survey-dietary-supplements. Accessed July 19,

2017.

- Now

trending: 10 ways the smoothie is evolving in 2016. Fast Casual website.

Available at: www.fastcasual.com/articles/now-trending-10-ways-the-smoothie-is-evolving-in-2016/. Accessed July 19, 2017.

- Uses

of Fenugreek in Ayurvedic Medicine. Livestrong website. Available at: www.livestrong.com/article/157975-uses-of-fenugreek-in-ayurvedic-medicine/. Accessed July 19, 2017.

- Ayurveda:

A New Way to Reduce Inflammation. Peoples Rx website. Available at: http://peoplesrx.com/ayurveda-a-new-way-to-reduce-inflammation/. Accessed July 19,

2017.

- Wolff

K. How Do FDA and FTC Regulate Ayurveda Products? October 3, 2017. Nutritional

Outlook. Available at: www.nutritionaloutlook.com/regulatory/how-do-fda-and-ftc-regulate-ayurveda-products. Accessed July 19,

2017.

- What

Are the Benefits of Citrus Bioflavonoids? Livestrong website. Available at: www.livestrong.com/article/425030-what-are-the-benefits-of-citrus-bioflavonoids/. Accessed July 19,

2017.

- Smith

T, Kawa K, Eckl V, Johnson J. Sales of Herbal Dietary Supplements in US

Increased 7.5% in 2015. HerbalGram. 2016;111:67-73. Available at: . Accessed July 19,

2017.

- Krieger

E. Got matcha? Five healthy foods that will make their mark on 2016. January

12, 2016. The Wall Street Journal. Available at: www.washingtonpost.com/lifestyle/wellness/got-matcha-five-healthy-foods-that-will-make-their-mark-on-2016/2016/01/11/7a92bfca-b3dc-11e5-a76a-0b5145e8679a_story.html. Accessed July 19,

2017.

- Sager

R. 2016 food trends we’re so over and 5 big ideas we can’t for in 2017. Fox

News website. Available at: www.foxnews.com/food-drink/2016/12/30/2016-food-trends-were-so-over-and-5-big-ideas-cant-for-in-2017.html. Accessed July 19,

2017.

- Moloughney

S. Energy Trends: The Market Charges On. January 3, 2017. Nutraceuticals

World. Available at: www.nutraceuticalsworld.com/issues/2017-01/view_features/energy-trends-the-market-charges-on/. Accessed July 19,

2017.

- Can

Garcinia Cambogia Help with Weight Loss? Healthline website. Available at: www.healthline.com/health/garcinia-cambogia-weight-loss#what-is-it1.

Accessed July 25, 2017.

- Yerba

mate. WebMD website. Available at: www.webmd.com/vitamins-supplements/ingredientmono-828-yerba%20mate.aspx.

Accessed July 25, 2017.

- What

is green coffee bean extract? Healthline website. Available at: http://www.healthline.com/health/green-coffee-bean-weight-loss.

Accessed July 25, 2017.

- Romm

A. Adaptogens: Herbs for Beating Stress, Fighting Fatigue & Banishing

Cravings. Aviva Romm, MD website. Available at: https://avivaromm.com/adaptogens-beating-stress/.

Accessed July 19, 2017.

- Cotton

S. Menthol. March 6, 2013. Chemistry World. Available at: https://www.chemistryworld.com/podcasts/menthol/6109.article.

Accessed July 19, 2017.

- Pina

P. The Rise of Functional Foods. April 2016. Think with Google website.

Available at: www.thinkwithgoogle.com/consumer-insights/2016-food-trends-google/.

Accessed July 19, 2017.

- Food

Trends 2016. Google. Available at: https://think.storage.googleapis.com/docs/FoodTrends-2016.pdf.

Accessed July 19, 2017.

- Wang

J. The A to Z of health and fitness trends for 2016. January 2, 2017. South

China Morning Post. Available at: http://www.scmp.com/lifestyle/health-beauty/article/1896785/z-hot-button-health-issues-2016.

Accessed July 19, 2017.

- Wellness

trends to enhance your life in 2016. December 22, 2015. CBS News website.

Available at: http://www.cbsnews.com/news/wellness-trends-to-enhance-your-life-in-2016/. Accessed July 19, 2017.

- Norton

S. 16 health trends to look out for in 2016. January 19, 2016. The Independent.

Available at: www.independent.co.uk/life-style/16-health-trends-to-look-out-for-in-2016-a6815211.html.

Accessed July 19, 2017.

- Panossian

A, Wagner H. Adaptogens: A review of their history, biological activity, and

clinical benefits. HerbalGram. 2011;90:52-63. Available at: http://cms.herbalgram.org/herbalgram/issue90/Feat_Adaptogens.html.

Accessed July 19, 2017.

- Chapter 1: A Field Trip. In: Green J. The Herbal

Medicine-Maker’s Handbook: A Home Manual. New York, NY; Crossing Press:

2000:15-16.

- Dandelion

root with herb. Blumenthal M, Goldberg A, Brinckmann J. Herbal Medicine:

Expanded Commission E Monographs. Austin, TX: American Botanical Council;

Boston: Integrative Medicine Communications, 2000. Available at: http://cms.herbalgram.org/expandedE/Dandelionrootwithherb.html. Accessed July 25,

2017.

- Dandelion.

The University of Maryland Medical Center website. Available at: www.umm.edu/health/medical/altmed/herb/dandelion. Accessed July 19,

2017.

- 7

Ways Dandelion Tea Could Be Good for You. Healthline website. Available at: www.healthline.com/health/ways-dandelion-tea-could-be-good-for-your#3. Accessed July 19,

2017.

- Bitter

Herbs for Better Digestion. Riordan Clinic website. Available at: https://riordanclinic.org/2014/03/bitter-herbs-for-better-digestion/. Accessed July 19,

2017.

- Breslin

PAS. An evolutionary perspective on food and human taste. Current Biology.

2013;23(9):409-418. Available at: www.sciencedirect.com/science/article/pii/S0960982213004181. Accessed July 19,

2017.

- Moloughney

S. Digestive Health: A Critical Pathway to Wellness. October 3, 2016.

Nutraceuticals World. Available at: www.nutraceuticalsworld.com/issues/2016-10/view_features/digestive-health-a-critical-pathway-to-wellness/. Accessed July 19,

2017.

- French

S. The Mind of the Consumer: Digestive Health. November 2016. Natural

Products INSIDER. Available at: www.naturalproductsinsider.com/~/media/Files/Nutrition/Ebooks/2016/11/11-16INS-MotC-DigestiveHealth-s.pdf. Accessed July 19,

2017.

- Schultz

H. Network marketing continues to be growing outlet for supplements.

NutraIngredients-USA website. Available at: www.nutraingredients-usa.com/Markets/Network-marketing-continues-to-be-growing-outlet-for-supplements. Accessed July 19,

2017.

|