Issue:

119

Page: 62-71

Herbal Supplement Sales in US Increased 8.5% in 2017, Topping $8 Billion

by Tyler Smith, Kimberly Kawa, Veronica Eckl, Claire Morton, Ryan Stredney

HerbalGram.

2018; American Botanical Council

Strongest

sales growth in more than 15 years bolstered by continued popularity of

Ayurvedic herbs and new formulations of botanicals with general health and

nutrition benefits

Introduction

In 2017, retail sales of herbal dietary

supplements in the United States surpassed $8 billion for the first time,

reaching an estimated total of $8.085 billion. Consumer spending increased by

approximately $633 million, or 8.5%, from 2016 — the strongest US sales growth

for herbal supplements in more than 15 years. Total US retail sales have

increased every year since 2004, and since then, consumer spending on herbal

supplements has nearly doubled.

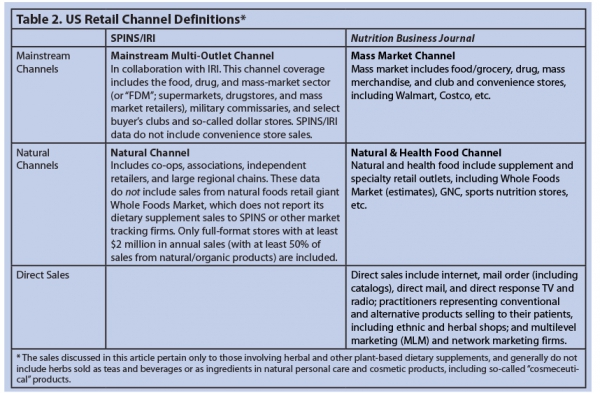

The information

presented in this report is based on retail sales data provided by the market

research firms SPINS and IRI, both based in Chicago, Illinois, and the Nutrition Business Journal (NBJ), part of the New Hope Network, a

Boulder, Colorado-based natural products industry-focused media company owned

by Informa. SPINS collaborated with IRI to determine total retail sales of

herbal dietary supplements in the mainstream multi-outlet retail channel. NBJ

calculated total overall sales of herbal supplements as well as breakdowns by

market channel and product type (single-herb vs. combination-herb supplements).

In addition to the

overall sales growth for herbal dietary supplements, total retail sales

increased in all market channels in 2017, according to NBJ estimates. The

strongest growth was seen in direct sales of herbal supplements, which totaled

$4.012 billion in 2017, an 11.2% increase from the previous year. Mass-market

retail sales grew by 8.4% to reach an estimated total of $1.449 billion in

2017, and herbal supplement sales in natural and health food stores, which

totaled $2.624 billion in 2017, increased by 4.7% from the previous year.

The SPINS/IRI

sales data for individual herbs discussed in this report, and those listed in

Tables 4 and 5, reflect sales of dietary supplements in which that herb is the

primary ingredient. This includes only products that meet the legal definition

of a dietary supplement per the US Food and Drug Administration.1

The figures in this report reflect the most current estimates (as of July 2018)

for herbal dietary supplement sales during the 52-week period that ended

January 1, 2018.

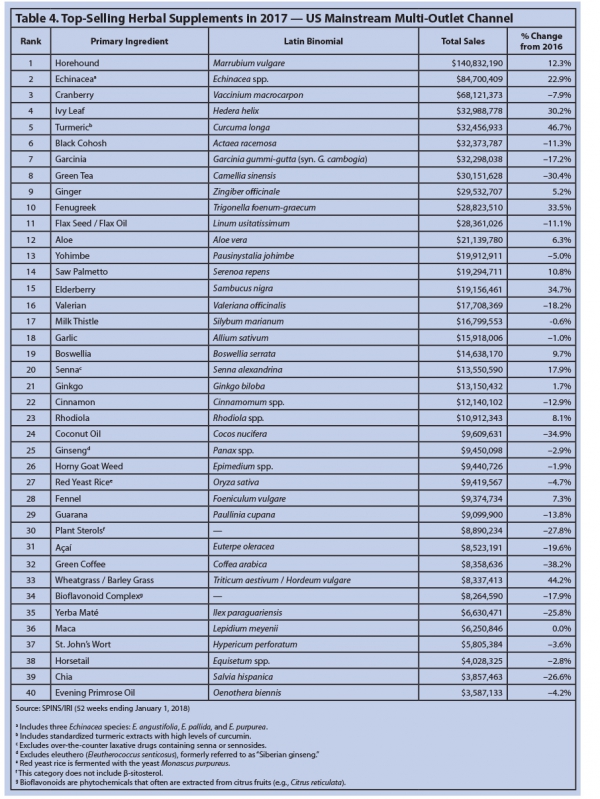

Mainstream Channel

According to SPINS/IRI data, mainstream multi-outlet retail sales of

herbal dietary supplements totaled $925,935,334 in 2017, a marginal increase of

0.698% from the previous year. The substantial differences between the

mainstream sales totals from SPINS/IRI and NBJ can be explained in part by the

organizations’ differing channel definitions. SPINS, for example, does not

include convenience store sales in its mainstream channel data.

For the fifth consecutive year, horehound (Marrubium vulgare,

Lamiaceae) was reported as the top-selling herbal dietary supplement ingredient

in mainstream US retail outlets. In this channel, horehound supplement sales

totaled $140,832,190 in 2017, a 12.3% increase

from 2016. Records of the medicinal use of horehound for respiratory

conditions date back to the first century,2,3 and the herb is still

commonly used for its expectorant and cough-suppressant properties, typically

in the form of cough drops and lozenges. (However, according to SPINS, one of

the top-selling horehound products in 2017 was in the form of a single-herb

extract marketed for respiratory health.)

With a 46.7% increase in sales from 2016, turmeric (Curcuma longa,

Zingiberaceae) experienced the strongest sales growth in the 2017 mainstream

retail channel. Consumers spent a total of $32,456,933 on turmeric supplements

in mainstream retail stores in 2017, an increase of roughly $10.3 million from

the previous year. This increase in sales earned turmeric a spot as the fifth

top-selling mainstream herbal supplement ingredient, up from its 10th-place

rank in 2016.

Consumer interest in turmeric has increased substantially in recent

years. In its 2016 Food Trends report, Google classified turmeric as the

“breakout star” of the functional food movement from 2011 to 2016, with Google

searches for the ingredient increasing by 300% during that time.4,5

The rise of this golden spice has coincided with increased consumer

familiarity with and interest in Ayurveda, a traditional medicine system of

India. In addition to being a widely used food ingredient (e.g., in curries),

turmeric has been used medicinally in Ayurveda to address a diverse range of

health issues, including ulcers, joint pain, skin conditions, inflammation,

respiratory conditions, and kidney and liver disorders, among others.6

Turmeric sales may have also benefited from the viral popularity of

“wellness tonics,” which Whole Foods named as one of the top 10 food trends of

2017.7 Golden milk and turmeric lattes, which typically contain

turmeric and other spices added to warmed milk or espresso, were among the

year’s trending tonics, with major coffee chains such as Starbucks and Peet’s

adding various turmeric-containing options to their menus in 2017.8

According to SPINS, the top-selling mainstream turmeric products in

2017 were marketed for non-specific health conditions. However, mainstream

consumers increasingly are seeking condition-specific turmeric supplements,

particularly those for joint health, immune health, and pain and inflammation.

Modern research on turmeric has largely focused on curcuminoids, a group of

biologically active compounds that includes curcumin. Evidence from human

clinical trials supports some of turmeric’s traditional Ayurvedic uses,

including for pain management, gastrointestinal disorders, and skin conditions.9

In addition to turmeric, four other botanical ingredients saw sales

increases of more than 30% in the 2017 mainstream channel: wheatgrass/barley

grass, elderberry, fenugreek, and ivy leaf.

Sales of wheatgrass (Triticum aestivum, Poaceae) and barley

grass (Hordeum vulgare, Poaceae) supplements, which experienced the

greatest mainstream sales growth in 2016, grew by 44.2% in 2017. These ingredients

likely have continued to benefit from the consumer desire for ingredients with

general health and wellness benefits, as discussed later in this report.

Sales of elderberry (Sambucus nigra, Adoxaceae) and ivy leaf (Hedera

helix, Araliaceae), which are typically used to support immune and

respiratory health,10 increased by 34.7% and 30.2%, respectively.

Increased sales of these supplements may have been related to the

higher-than-average number of flu-like illnesses in the United States from

mid-December 2016 to mid-March 2017, as reported by the US Centers for Disease

Control and Prevention.11

Fenugreek (Trigonella foenum-graecum, Fabaceae), an herb

traditionally used to stimulate breast milk production, saw an increase in

sales of 33.5% from 2016. Multiple human clinical trials published in 2016 and

2017 investigated a range of other potential uses for fenugreek, including for

age-related symptoms of androgen decline,12 menopausal symptoms,13

and low sperm counts.14 Sales of fenugreek supplements may have also

benefited from the increased familiarity with Ayurveda, in which it has been

used traditionally for millennia.15

Only three herbal supplement ingredients in the 2017 mainstream channel

experienced sales decreases of more than 30%: green coffee (–38.2%), coconut

oil (–34.9%), and green tea (–30.4%). Once touted for their weight-loss

benefits by the popular daytime television host Mehmet Oz, MD, green tea (Camellia

sinensis, Theaceae) and green coffee (Coffea arabica, Rubiaceae)

extracts peaked in popularity in 2014, and their sales have declined steadily

since then. This is likely due in part to increased consumer skepticism of

weight-loss products, whose marketing claims have been questioned publicly in

Senate hearings16 and consumer education campaigns17 in

recent years. Instead of turning to single-ingredient “miracle”

weight-loss supplements, consumers’ attitudes toward weight management products

appear to have shifted. “Consumers … are taking a more balanced, holistic

approach to managing weight as an attempt to improve health,” noted Informa

Managing Editor Rachel Adams in a recent publication from Natural Products

INSIDER.18

Coconut oil (Cocos nucifera, Arecaceae) exploded in popularity in

2013 with a roughly 4,000% increase in sales from 2012, but mainstream sales of

this ingredient started to decline in 2016. The continued decline in 2017 may

be due in part to a highly publicized Presidential Advisory released in June

2017 from the American Heart Association. The advisory, which suggested that

coconut oil was no healthier than beef fat in terms of potential cardiovascular

effects, noted: “Because coconut oil increases LDL cholesterol, a cause of

[cardiovascular disease], and has no known offsetting favorable effects, we

advise against the use of coconut oil.”19

As in previous years, HerbalGram chose to exclude certain ingredients from SPINS and IRI’s

tally of the 40 top-selling herbal supplements in the US mainstream retail

channel. As the only branded supplement on the list, Relora (InterHealth

Nutraceuticals Inc.; Benicia, California), a proprietary blend of magnolia (Magnolia officinalis, Magnoliaceae) and phellodendron (Phellodendron amurense, Rutaceae) bark extracts, was not included in this year’s report. Had it

been included, Relora would have been the 38th top-selling supplement in 2017,

despite a 25.6% decline in sales from 2016.

Natural

Channel

According to

SPINS, sales of herbal dietary supplements in the US natural channel totaled an

estimated $405,153,959 in 2017, an increase of 8.9% from 2016. NBJ, which,

unlike SPINS, includes sales from Whole Foods Market in its natural and health

food retail channel, determined significantly higher sales of $2.624 billion in

this channel. In general, natural channel sales come from so-called “core shoppers,” who tend to be committed

to a natural lifestyle. “Peripheral

shoppers,” who typically are less committed to natural products and wellness

trends, are more likely to purchase dietary supplements in the mainstream

channel.

For the fifth

consecutive year, turmeric was the top-selling herbal supplement ingredient in

natural retail outlets with sales totaling $50,346,121 in 2017, an increase of

12.2% from 2016. While mainstream consumers primarily purchased turmeric

supplements for non-specific health conditions, the greatest sales of turmeric

supplements sold in the natural channel were marketed for pain and

inflammation. Non-specific health conditions, however, still represented the

second largest market share of turmeric supplements sold in this channel,

followed by those for joint health and cardiovascular health.

For the first time, cannabidiol (CBD), a

naturally occurring, non-intoxicating compound in Cannabis species

(Cannabaceae), ranked among the 40 top-selling herbal supplement ingredients in

the US natural channel. CBD was the 12th top-selling ingredient in this channel

with total sales of $7,583,438 in 2017, an increase of 303% from the previous

year.

SPINS has been

tracking sales of CBD in both mainstream and natural retail channels since

2016, but the legality of this ingredient remains murky. The US Drug

Enforcement Administration considers “marihuana” and “marihuana extracts”

illegal under Schedule I of the Controlled Substances Act,20 but

certain allowances were made for the research and limited production of

industrial hemp when the Farm Bill of 2013 became law in early 2014.21 In

an effort to avoid potential legal issues, many manufacturers have chosen to

produce and market products with only “hemp-derived” CBD.

CBD preparations

are perhaps best known for their documented benefits for treatment-resistant

epilepsy,* but CBD is “attracting increasing interest as ‘a pharmacological

agent of wondrous diversity,’ with analgesic, anti-inflammatory, antioxidant,

antiemetic, anxiolytic,” and numerous other documented properties, according to

a recent review of CBD claims.23 The majority of CBD sales in 2017

were attached to products with non-specific health focuses, according to SPINS,

but sales of condition-specific CBD formulations, such as those for mood

support and pain and inflammation, are beginning to emerge. Nigella (Nigella

sativa, Ranunculaceae), also known as black cumin or black seed, also

experienced significant sales growth in 2017. Retail sales of nigella rose by

202.5% from 2016, making it the 23rd top-selling herb in this channel.

According to SPINS, liquid seed oil preparations with non-specific health

focuses made up the majority of nigella supplement sales in both natural and

mainstream retail stores in 2017.

Archeological

evidence suggests that nigella has been used as a food and medicine since the

third millennium BCE, and the herb is still commonly used in traditional

medicine systems in Asia. In Ayurveda, dried nigella seeds are used to treat

various digestive issues (e.g., gas and diarrhea), and in the Unani system of

medicine, nigella is used to treat a range of conditions, including asthma,

migraine, joint and back pain, and skin diseases. Evidence from human clinical

trials suggests that nigella preparations may have some benefits for

respiratory conditions, rheumatoid arthritis, and functional dyspepsia.24

Moringa (Moringa

oleifera, Moringaceae), which also made its debut among the 40

top-selling herbs in the natural channel in 2017, was the only other ingredient

with an increase in sales of more than 30% from 2016. Moringa, like nigella, is

a botanical commonly used in Ayurvedic medicine that has general health and

nutrition benefits. Also known as

horseradish tree (not related to the spice horseradish [Armoracia rusticana,

Brassicaceae]), moringa is cultivated and consumed widely in South Asian

countries. The leaves are rich in protein, beta-carotene, vitamin C, calcium,

and potassium, and various plant parts have been used traditionally in India to

treat inflammation and infection, as well as gastrointestinal, cardiovascular,

and liver conditions.25 According to SPINS, powders made up the

majority of moringa supplement sales in the 2017 natural channel.

Consumers suffering from “pill fatigue,” who increasingly are looking

for ingredients with general wellness and nutrition benefits in alternative

delivery forms (e.g., powders and liquids), likely contributed to the sales

growth of nigella and moringa in 2017.26 In addition, the herbs’

long history of use in Ayurveda may have added to their appeal, particularly

for core consumers in this channel who tend to be more familiar with natural

product trends. Several other botanicals with traditional Ayurvedic uses

experienced sales growth in the natural channel, including ashwagandha (Withania

somnifera, Solanaceae; 25.6%), ginger (Zingiber officinale,

Zingiberaceae; 19.8%), and garlic (Allium sativum, Amaryllidaceae; 16%).27

Coconut oil was the only ingredient in the 2017 natural channel with a

significant decline in sales (–23.5%).

Direct Sales

Direct sales of herbal supplements increased by 11.2% from 2016,

reaching an estimated $4.012 billion in 2017, according to NBJ. This is the

strongest percentage sales growth in this channel in more than a decade, and

the first time since 2012 that growth in the direct sales channel outpaced that

of the mainstream and natural/health food channels. Direct channel sales of

herbal dietary supplements include multilevel marketing companies (also known

as network marketing companies). This channel also encompasses mail- and

internet-order sales companies, direct-response TV and radio sales, and sales

by health practitioners.

Single-Herb vs. Combination-Herb Supplements

For the seventh consecutive year, sales growth of combination-herb

supplements was stronger than that of single-herb supplements. Across all

channels, sales of combination-herb supplements increased by 12.9% from 2016,

and sales of single-herb supplements increased by 5.6%. Combination-herb

formulas generally are intended for more specific uses than single-herb

supplements. Despite the continued growth for combination-herb products,

single-herb supplements have composed the majority of overall sales for more

than a decade.

Conclusion

After the highly publicized and controversial campaign against certain

herbal supplements led by the New York attorney general in 2015, the natural

products industry entered a period of self-reflection. Since then, many

responsible members of the dietary supplements industry have taken significant

steps to regain consumer trust by improving transparency along the supply

chain, enhancing traceability of raw botanical materials, and bringing

attention to ingredients with potential adulteration concerns, among other

efforts. The record 8.5% growth in herbal supplement sales in 2017 suggests

that these efforts may be paying off. Sales in both natural retail outlets and

mainstream stores reflect heightened consumer interest in once-obscure

botanicals and medical traditions. Increased familiarity with Ayurvedic herbs,

new formulation options, and consumer demand for culinary botanicals with

general health and nutrition benefits continued to drive sales of these

products in 2017.

References

- FDA basics: What is a dietary supplement? US Food & Drug Administration website. Available at: www.fda.gov/aboutfda/transparency/basics/ucm195635.htm. Accessed July 19, 2017.

- Horehound herb. Natural Remedies website. Available at: www.naturalremedies.org/horehound/. Accessed July 19, 2017.

- Horehound. University of Michigan Medicine website. Available at: www.uofmhealth.org/health-library/hn-2109003. Accessed July 19, 2017.

- Pina P. The Rise of Functional Foods. April 2016. Think with Google website. Available at: www.thinkwithgoogle.com/consumer-insights/2016-food-trends-google/. Accessed July 19, 2017.

- Food Trends 2016. Google. Available at: https://think.storage.googleapis.com/docs/FoodTrends-2016.pdf. Accessed July 19, 2017.

- Engles G. Turmeric — Curcuma longa. Family: Zingiberaceae. HerbalGram. 2009;84:1-3. Available at: http://cms.herbalgram.org/herbalgram/issue84/article3450.html. Accessed July 3, 2018.

- Whole Foods Market serves up top 10 trends for 2017 [press release]. Austin, TX: Whole Foods Market; December 6, 2016. Available at: https://media.wholefoodsmarket.com/news/whole-foods-market-serves-up-top-10-trends-for-2017. Accessed July 3, 2018.

- Maynard M. Turmeric jumps from the spice rack to the coffee cup at Peet’s. January 11, 2018. Forbes. Available at: www.forbes.com/sites/michelinemaynard/2018/01/11/turmeric-jumps-from-the-spice-rack-to-the-coffee-cup-at-peets/. Accessed July 3, 2018.

- Curcuma longa. Evidence for Efficacy (Human Data). HerbMedPro website. Available at: www.herbmed.org/Sponsored/turmericsubcat.html?categoryID=1. Accessed July 3, 2018.

- Cook S. Clearing up the cold and flu controversy. Natural Medicine Journal website. Available at: www.naturalmedicinejournal.com/sites/default/files/cold_and_flu.pdf. Accessed July 3, 2018.

- Frequently Asked Flu Questions 2016-2017 Influenza Season. US Centers for Disease Control and Prevention website. Available at: https://www.cdc.gov/flu/about/season/flu-season-2016-2017.htm. Accessed July 11, 2018.

- Rao A, Steels E, Inder WJ, Abraham S, Vitetta L. Testofen, a specialised Trigonella foenum-graecum seed extract reduces age-related symptoms of androgen decrease, increases testosterone levels and improves sexual function in healthy aging males in a double-blind randomised clinical study. Aging Male. 2016;19(2):134-142. Available at: www.ncbi.nlm.nih.gov/pubmed/26791805. Accessed June 5, 2018.

- Steels E, Steele ML, Harold M, Coulson S. Efficacy of a proprietary Trigonella foenum-graecum L. de-husked seed extract in reducing menopausal symptoms in otherwise healthy women: a double-blind, randomized, placebo-controlled study. Phytotherapy Research. 2017;31(9):1316-1322. Available at: www.ncbi.nlm.nih.gov/pubmed/28707431. Accessed July 5, 2018.

- Maheshwari A, Verma N, Swaroop A, et al. Efficacy of Furosap, a novel Trigonella foenum-graecum seed extract, in enhancing testosterone level and improving sperm profile in male volunteers. International Journal of Medical Sciences. 2017;14(1):58-66. Available at: www.ncbi.nlm.nih.gov/bmed/28138310. Accessed July 5, 2018.

- Basch E, Ulbricht C, Kua G, Szapary P, Smith M. Therapeutic applications of fenugreek. Alternative Medicine Review. 2003;8(1):20-27. Available at: http://inconnate.com/Download/Fenugreek/document3.pdf. Accessed July 3, 2018.

- Smith T. Dr. Oz’s “Miracle” Herbal Weight-Loss Products: The Senate Hearing, Advertising Regulations, and Science behind the Claims. HerbalGram. 2014;103:57-61. Available at: http://cms.herbalgram.org/herbalgram/issue103/HG103-legreg-droz.html. Accessed July 5, 2018.

- Dietary Supplements for Weight Loss. National Institutes of Health website. Available at: https://ods.od.nih.gov/factsheets/WeightLoss-HealthProfessional/. Accessed July 5, 2018.

- Natural Support for Healthy Waistlines. June 2017. Natural Products INSIDER. Available at: www.naturalproductsinsider.com/legal-compliance/natural-support-healthy-waistlines. Accessed July 3, 2018.

- Sacks FM, Lichtenstein AH, Wu JHY, et al. Dietary Fats and Cardiovascular Disease: A Presidential Advisory From the American Heart Association. American Heart Association website. Available at: http://circ.ahajournals.org/content/early/2017/06/15/CIR.0000000000000510.dea.

- Clarification of the New Drug Code (7350) for Marijuana Extract. US Department of Justice website. Available at: www.deadiversion.usdoj.gov/schedules/marijuana/m_extract_7350.html. Accessed July 3, 2018.

- Hemp Research & Pilot Programs Authorized in Sec. 7606

of The Farm Bill. VoteHemp website. Available at: www.votehemp.com/2014_farm_bill_section_7606.html. Accessed July 3, 2018.

- FDA approves first drug comprised of an active ingredient derived from marijuana to treat rare, severe forms of epilepsy [press release]. Silver Spring, MD: US Food and Drug Administration; June 25, 2018. Available at: www.fda.gov/NewsEvents/Newsroom/PressAnnouncements/ucm611046.htm. Accessed July 5, 2018.

- Russo EB. Cannabidiol claims and misconceptions. Trends Pharmacol Sci. March 2017;38(3):198-201. Available at: http://cms.herbalgram.org/herbclip/575/021745-575.html. Accessed July 3, 2018.

- Engles G, Brinckmann J. Nigella herb profile. HerbalGram. 2017;114:8-16. Available at: http://cms.herbalgram.org/herbalgram/issue114/hg114-herbprofile.html. Accessed July 3, 2018.

- Anwar F, Latif S, Ashaf M, Gilani AH. Moringa oleifera: A Food Plant with Multiple Medicinal Uses. Phytotherapy Research. 2007;21:17-25. Available at: https://miracletrees.org/moringa-doc/moringa_multiple_medicinal_uses.pdf. Accessed July 3, 2018.

- Runestad T. 12 ingredient and supplement trends to look out for in 2017. December 21, 2016. New Hope Network website. Available at: www.newhope.com/products-and-trends/12-ingredient-and-supplement-trends-look-out-2017. Accessed July 3, 2018.

- Vaida ADB, Devasagayam TPA. Current Status of Herbal Drugs in India: An Overview. Journal of Clinical Biochemistry and Nutrition. 2007;41(1):1-11. Available at: www.ncbi.nlm.nih.gov/pmc/articles/PMC2274994/. Accessed July 3, 2018.

|