Issue: 86 Page: 62-65

Herbal Supplement Sales Rise in All Channels in 2009

by Courtney Cavaliere, Patrick Rea, Mary Ellen Lynch, Mark Blumenthal

HerbalGram. 2010;86:62-65 American Botanical Council

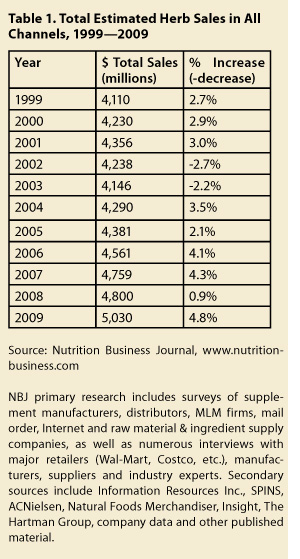

Sales of herbal and botanical dietary supplements in the United States rose by a relatively large amount in 2009, according to data gathered from market research firms. Information Resources Inc. (IRI) found that herbal supplement sales growth in the mainstream market channel in 2009 was about double that of 2008,1 and SPINS has reported moderate growth in botanical supplement sales in the health and natural food stores sector.2 Nutrition Business Journal (NBJ), meanwhile, has pooled various primary and secondary data sources and determined that total estimated herb sales in all channels of the US market rose by 4.8% in 2009 (see Table 1).

Herbal dietary supplements are sold in the United States through a variety of market channels, including health and natural food stores; food, drug, and mass market (FDM) retailers; warehouse and convenience stores; mail order, radio, and television direct sales; Internet sales; network or multi-level marketing (MLM) companies; health professionals in their offices (e.g., acupuncturists, chiropractors, naturopaths, some conventional physicians, massage therapists); and others. While market data companies are able to generate relatively accurate data of herbal dietary supplement sales for some market channels through cash register and computer scanning records, most channels do not have such tracking capabilities and are estimated with a lesser degree of accuracy. However, by pooling various sources of available data and modeling the remaining multi-channel firms, NBJ has arrived at a total estimated figure for all US herbal dietary supplement sales in 2009 of $5,030,000,000.

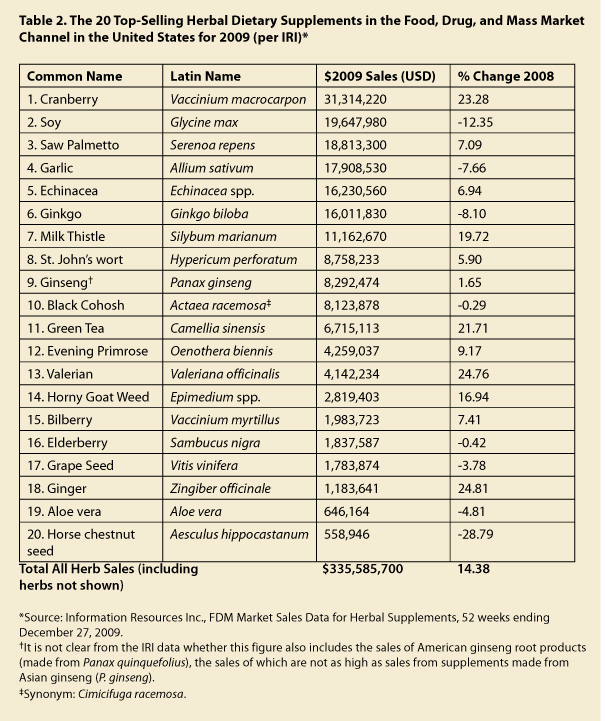

According to data supplied by IRI of Chicago, Illinois, sales of herbal dietary supplements in the FDM channel increased by about 14.4% in 2009 from 2008 sales, for a total figure of $335,585,700.1 However, the IRI data does not represent the entire FDM channel, as it does not include sales reports from Wal-Mart, Sam’s Club and other large warehouse buying clubs, or from convenience stores.

Previous statistics from IRI found that sales of herbal supplements increased for the first time in the FDM channel in 2007, after showing steady decreases for several years.3 Sales of herbal supplements increased by 7.6% in 2007 over the preceding year, then increased by 7.2% in 2008. This year’s IRI data seems particularly significant as sales of herbal supplements from mainstream market retailers have reached double-digit growth.1 The 20 top-selling single herbal dietary supplements within the FDM channel, as determined by IRI, are listed in Table 2.

Cranberry (Vaccinium macrocarpon, Ericaceae) supplements, which were the top-selling herbal supplement product within the FDM channel in 2008, have remained the leader in this category for 2009. Sales of cranberry supplements rose by 23.3% in 2009. Sales of milk thistle (Silybum marianum, Asteraceae), green tea (Camellia sinensis, Theaceae), and ginger (Zingiber officinale, Zingiberaceae) supplements also made significant strides in the FDM channel, whereas sales of horse chestnut seed (Aesculus hippocastanum, Hippocastanaceae) continued to decrease in 2009.1

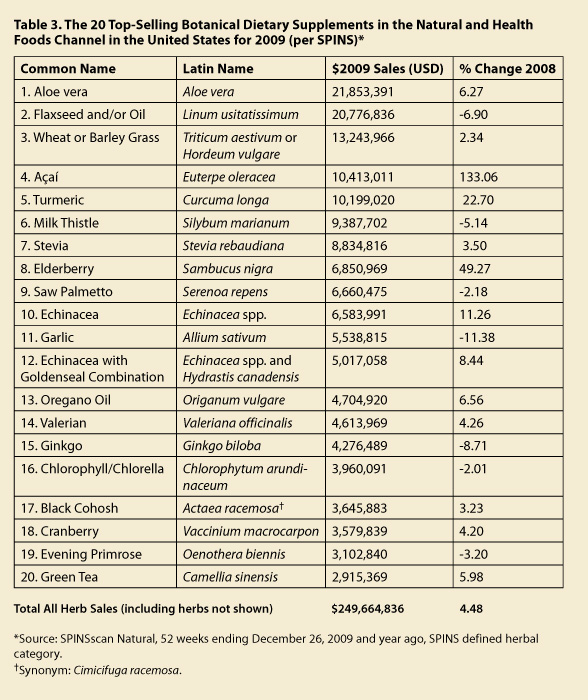

The market information firm SPINS of Schaumburg, Illinois, meanwhile, has determined that sales of botanical dietary supplements in the natural and health foods channel increased by 4.5% in 2009 from 2008 sales, for a total of $249,664,836.2 SPINS collects data on supplement sales from a variety of natural and health foods retailers. As with IRI’s data, however, the SPINS data does not represent the entire natural and health foods channel; in particular, it does not include sales data from the natural foods retailer Whole Foods. (In previous years, SPINS estimated sales from Whole Foods using an algorithm. SPINS, however, has discontinued its Whole Foods estimation. Data from SPINS in the previous HerbalGram market report [published in issue 82] did include a Whole Foods estimation,3 which is why SPINS’ 2008 data published in HerbalGram 82 and in this market report will appear dissimilar.)

The 20 top-selling botanical dietary supplements within the natural and health foods channel, as determined by SPINS, are listed in Table 3. According to SPINS, aloe (Aloe vera, Liliaceae) supplements were the top-selling botanical supplements within the natural and health foods channel. The so-called “superfruit” supplement açaí (Euterpe oleracea, Arecaceae), meanwhile, again experienced a particularly significant increase in sales in this market channel. Sales of açaí rose 120.5% in 2008 over the previous year, and the supplement has exceeded this growth in 2009 with a 133.1% increase over 2008 sales. Turmeric (Curcuma longa, Zingiberaceae) is another botanical supplement that enjoyed significant growth in 2009 in this channel.

Herbal supplements for the treatment of colds and flu seemed to be big sellers in 2009, probably due in part to media focus and global concern regarding the Influenza A(H1N1) virus (aka “swine flu”) during 2009. Sales of echinacea (Echinacea spp., Asteraceae) increased in both the FDM and natural and health foods channels during 2009. Elderberry (Sambucus nigra, Caprifoliaceae) supplement sales grew by nearly 50% in the natural and health foods channel, while elderberry remained relatively stable in the FDM channel. Although not a top-20 botanical supplement, the immune-modulating herb astragalus (Astragalus membranaceus, Fabaceae) also experienced a rise in sales in the natural and health foods channel in 2009, with a 27.7% increase over 2008 sales.

In reviewing the IRI and SPINS data, it bears emphasis that market research companies use different definitions and coding techniques to compile and analyze data on a particular topic. Therefore, data from IRI on botanical supplement sales in the FDM channel and data from SPINS on botanical supplement sales in the natural and health foods channel—though both considered reliable statistics and important for understanding the herbal market—may not be directly comparable. The 2 market research firms categorize products differently and do not necessarily include the same products in their data of herbal supplement sales. For example, some of the leading products noted by SPINS as top-selling botanical supplements (including flaxseed [Linum usitatissimum, Linaceae] and stevia [Stevia rebaudiana, Asteraceae]) are not classified as individual herbal supplements in IRI’s data for the FDM channel. Likewise, NBJ’s total estimated figure for herbal supplement sales may or may not include some herbal/botanical supplements contained within the data of IRI and/or SPINS.

Sales of single herbal dietary supplements (monopreparations) grew by 6.3%, and sales of combination herbal supplements increased by 2% in 2009, according to data from NBJ (see Table 4). Monopreparations typically pull in almost twice as much in sales as combinations.

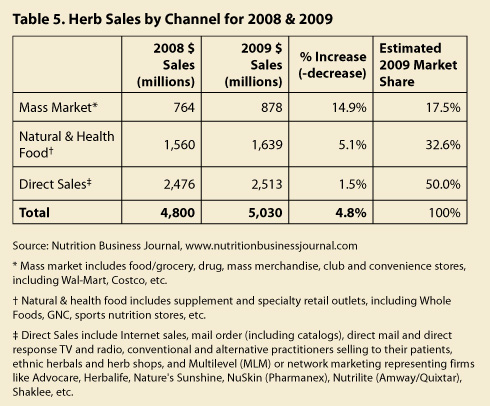

NBJ data also shows that herbal supplement sales increased in every channel in 2009 (see Table 5). According to NBJ, herbal dietary supplement sales increased in the FDM channel by nearly 15%, in the natural and health foods channel by around 5%, and in the direct sales channel by 1.5%. NBJ’s market estimate also indicates that half of all herbal supplement sales occurred through the direct sales channel, followed by 32.6% of sales in the natural and health foods channel and 17.5% in the FDM channel. (NBJ’s figures for the FDM and natural and health foods channels do include estimates of sales from Wal-Mart and Whole Foods, in addition to other sources not considered by IRI and SPINS.)

These statistics from NBJ, IRI, and SPINS indicate that the economic downturn may have contributed to sales growth for herbal supplements, as it appears to have done for the dietary supplement industry as a whole. An article published in Newsweek in October 2009 noted that stores selling vitamins, minerals, and supplements benefited from the recession due to some Americans exchanging bad and/or expensive habits for healthier ones and from some Americans losing their health insurance and choosing supplements over costly prescriptions.4 The article also added that baby boomers have grown more obsessed with their health and wellness.

The Natural Marketing Institute (NMI), based in Harleysville, Pennsylvania, conducts annual surveys that reflect attitudes, purchasing trends, and use of supplements by consumers. NMI’s US data likewise shows that herbal supplement sales are being impacted by health-consciousness and frugality of the American public. According to Maryellen Molyneaux, president and managing partner of NMI, “In general, consumers are shopping less in natural channel stores and more in food, drug, and mass outlets for all things healthy and natural” (e-mail to C. Cavaliere, March 3, 2010). She explained that users of herbal supplements are often more educated about supplements, and they tend to search out the best deals (at least insofar as pricing is concerned)—which drives them to mass market outlets. Additionally, more mainstream consumers are trying to take control over their health issues. Some of the increase in herbal supplement sales could therefore be explained by more mainstream consumers seeking other options to conventional healthcare for treating and preventing their health concerns, as well as by channel switching among regular herbal supplement users.

“Consumers are looking for less expensive outlets, as 46% of herbal supplement users indicated their purchase behavior changes were manifested in ‘purchasing less expensive supplements,’ including store brands,” said Molyneaux.

References

- FDM Market Sales Data for Herbal Supplements, 52 weeks ending December 27, 2009. Chicago, IL: Information Resources Inc.

- SPINSscan Natural, Total US, 52 weeks ending December 26, 2009 and year ago, SPINS defined herbal category.

- Cavaliere C, Rea P, Lynch MD, Blumenthal M. Herbal supplement sales experience slight increase in 2008. HerbalGram. 2009;82:58-61.

- Gross D. Megavitamins: the vitamin business thrived through the recession. Why? Newsweek. October 30, 2009. Available at: www.newsweek.com/id/220283. Accessed March 24, 2010.

|