Issue:

99

Page: 60-65

Herb Supplement Sales Increase 5.5% in 2012: Herbal Supplement Sales Rise for 9th Consecutive Year; Turmeric Sales Jump 40% in Natural Channel

by Ashley Lindstrom, Carla Ooyen, Mary Ellen Lynch, Mark Blumenthal

HerbalGram.

2013; American Botanical Council

By Ashley Lindstrom1, Carla Ooyen2, Mary Ellen Lynch3, and Mark Blumenthal1

1 American Botanical Council, Austin, Texas, USA

2

Nutrition

Business Journal, New Hope Natural Media, Boulder, Colorado, USA

3 SPINS, Schaumburg, Illinois, USA

Total sales of herbal and botanical

dietary supplements in the United States increased an estimated total of 5.5%

in 2012, according to aggregated market statistics calculated by Nutrition Business Journal (Table 1).

This total sales growth is greater than the 5% increase in total sales

determined for 2011,1 marking the 9th year in a row in

which herb sales increased over the previous year (Table 2). These sales data

do not include sales of herbal teas or herbs sold in natural cosmetic products.

As has been the case in previous

years, total herb supplement sales growth in the different market channels

varied, according to statistics provided by market research firms, from a

respectable 2.2% over the previous year in the mainstream market (food, drug,

and mass market retail stores, FDM) to a stronger 6.1% increase in the natural

channel (natural and health food stores) (Table 1).

Unlike previous years when this

annual report has been published in HerbalGram,

the market research firms contributing econometric information have gained

access to more robust sales data than were available last year; as a result,

sales estimates from 2011 have been updated in several instances from those

previously reported.

Mainstream Retail Channel – Food,

Drug, and Mass Market (FDM)

In the FDM channel for 2012, a sales

total of $594,815,900 was calculated by the Chicago-based research firm

SymphonyIRI — which would appear to be an increase from 2011’s reported sales

figure of $379,286,600 (Table 3). However, SymphonyIRI’s channel coverage

expanded in 2012 to “Total US Multi-Outlet,” which includes the previously

measured supermarkets, drugstores, and mass market retailers, but now also

covers military commissaries and select club and dollar retail discount chains.

As a result of this more comprehensive coverage, SymphonyIRI determined that

mainstream herb sales actually decreased

by 1.06% in 2012. In general, however, the FDM channel represents continued

mainstream acceptance and success of numerous popular herbs, including bilberry

fruit extract, black cohosh root, garlic, ginger root, ginkgo leaf extract,

Asian ginseng root (with some American ginseng sales possibly mixed into the

statistics as merely “ginseng”), milk thistle fruit extract, saw palmetto

berry, St. John’s wort herb extract, and others.*

According to SymphonyIRI (Table 3),

few herbs among its top 20 experienced significant increases in growth, with

one exception being garlic, which “overtook” both soy and saw palmetto for the

first time since 2008, with an 11.78% increase over 2011 sales levels, making

it the second highest-selling FDM herb in 2012. Other top-20 herbs that

exhibited increases include milk thistle (+7.25%), valerian root (+7.21%), aloe

vera (+18.76%), and hawthorn (probably leaf with flower extract plus berry

preparations; +11.18%). Last year’s Herb Market Report included, for the first

time ever, sales data on top-selling herbs up to 40 (rather than just the top

20) in the FDM channel per SymphonyIRI. Herbs showing strong increases in the

top 21-40 rankings in this year’s report include spirulina (+30.60%), feverfew

(+31.76%), alfalfa (+100.14%), dong quai root (+101.16%), and maca (+22.84%).

Sales increases were not uniform

across the board, with some herbs experiencing significant declines in the FDM

market, according to the SymphonyIRI statistics. These include black cohosh

(-21.33%), grape seed (-14.28%), yohimbe (-19.75%), and red clover (-29.33%).

Compared to the SymphonyIRI data,

SPINS provides a slightly different ranking of total supplement sales in the

mainstream channel — which it is now referring to as “AOC” (or “all other

channels,” i.e., other than the

traditional rankings by SPINS of the natural channel, including FDM [including

Wal-Mart], in addition to dollar stores, military stores, and club stores

[excluding Costco]) due to its own expanded coverage — with sales actually

increasing by 3.6% to $860,384,627 (per listings in Table 5e, available in the

online version of this article: http://cms.herbalgram.org/herbalgram/issue99/hg99-mktrpt.html).

Illustrating the complexity of any

analysis of this segment, the Nutrition

Business Journal’s (NBJ) analysis for the total sales of herbal dietary

supplements in the total mainstream/FDM channel (including estimated sales in

buyers’ clubs and convenience stores, including Wal-Mart, Sam’s Club, Costco,

etc.) shows that herbal dietary supplement sales grew somewhere between the

figures reported by SymphonyIRI or SPINS, at an NBJ-calculated increase of

2.2%.

As was noted in last year’s

publication of this annual report, many of the most popular herbs sold in the

FDM market are either conventional foods and/or common spices. These include

barley, bilberry, cranberry, cayenne pepper, garlic, ginger, green tea, kelp,

and soy. Other “edible” or food-oriented herbs include elderberry, grape seed,

kelp, maca root, and spirulina.

Natural Channel

Some of the trends contributing to

growth in the natural channel were the increase in shots (small, drinkable

products containing liquid botanical extracts and other dietary ingredients

used for enhanced energy and other applications) as a delivery system for

dietary supplements as well as whole foods supplements. Despite some bad press

in 2011 that linked it to contamination with E. coli, fenugreek sales rose, indicating continued consumer

interest in herbs to aid lactation and male libido. The so-called “Dr. Oz

Effect” (the phenomenon of increased popularity of herbal dietary supplements

featured on the television show of Mehmet Oz, MD) was observed throughout all channels, particularly illustrated by

the increased sales of green coffee extract in the natural channel. Saffron

sales are on the rise, perhaps indicating that hoodia has a successor in the

weight-loss herbal supplement sector.

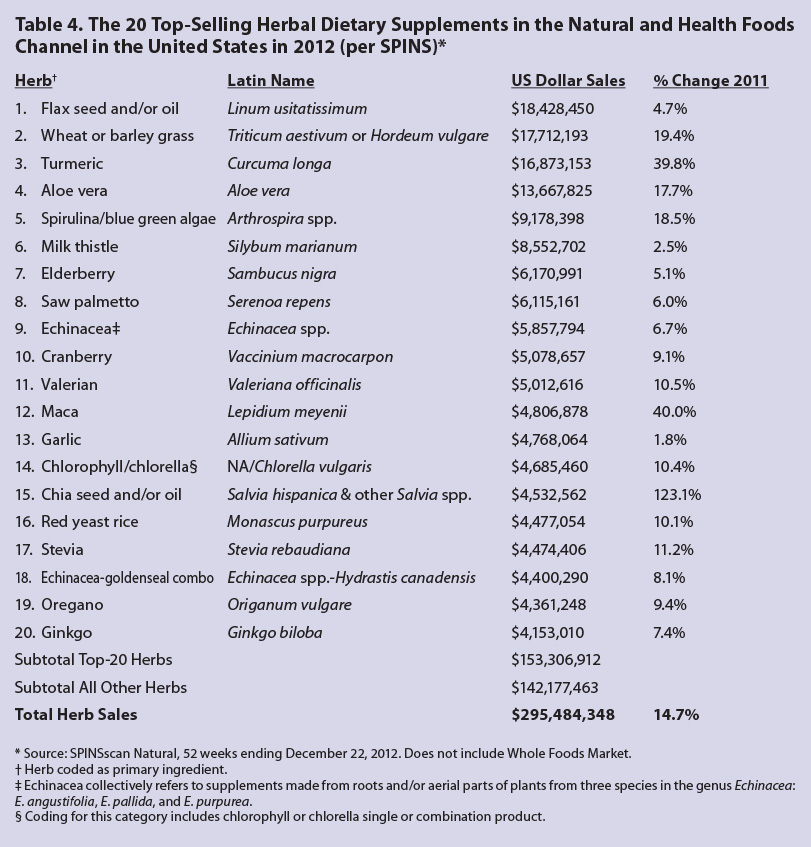

In the natural channel, total

calculated sales for herbal supplements in 2012, according to SPINS, were

$295,484,348, representing a whopping 14.7% growth over 2011 sales (Table 4) —

which were impressive at a 9%

increase over 2010 sales.

The rising popularity of whole foods

supplements and “food as medicine” — particularly for energy, stress reduction,

and reproductive conditions — may account for a significant amount of the

increased sales in this channel. Some herbal supplements are being packaged in

a fashion that allows consumers to customize the product for themselves in

homemade foods or beverages, such as smoothies. Typically, the natural channel

is characterized by what some market experts refer to as “core shoppers” —

those with a relatively strong commitment to a natural lifestyle, natural

foods, and natural-health modalities (compared to the “peripheral shoppers” who

have less of a personal commitment to natural foods, natural-health philosophy,

and who purchase the majority of their dietary supplements in the FDM channel).

Key herbal supplements show evidence

of significant growth in the natural channel; sales of the increasingly popular

turmeric root (and its extract concentrated to curcumin levels) grew 39.8%,

while various types of greens also showed remarkable growth, including: wheat

and/or barley grass (+19.4%), spirulina blue-green algae (+18.5%) (SPINS codes

spirulina single supplements and blue-green algae single supplements in the

same category; combinations of the two may also be represented), aloe vera (+17.7%), and chia seed/oil (a vegetable

source of short-chain omega-3 fatty acids; +123.1%). Also showing significant

sales in 2012 in the natural channel is maca, with a strong 40.0% increase from

2011.

Sales compiled by SPINS for the

natural channel do not include herb supplement sales in Whole Foods Markets, the

largest chain of natural food groceries in the United States. NBJ has estimated

6.1% growth for herb supplement sales in the total natural channel in 2012,

with its estimates attempting to include sales at those natural retailers (e.g., Whole Foods) not included by

SPINS. Some estimates suggest that sales of herbal dietary supplements in Whole

Foods might constitute as much as 50% of the entire natural channel’s sales,

but such estimates are not confirmed. If these estimates are valid, sales for

the total natural channel would be

about 100% higher than those reported by SPINS in Table 4.

Direct Sales

Sales of herbal dietary supplements

in the direct sales channel include multi-level marketing companies (aka

network marketing companies, e.g.,

Advocare, Herbalife, Morinda Bioactives, Nature’s Sunshine, Amway’s Nutrilite,

Pharmanex/NuSkin, Shaklee, USANA, and others), mail order and Internet sales

companies (e.g., iHerb, Indiana

Botanic Gardens, Swanson’s, et al.),

and healthcare practitioners. As shown in Table 1, further attesting to the

overall robustness of the herbal supplement market in the past year, this

segment experienced healthy growth of an estimated 6.3% at $2,742,000, up from

sales of $2,578,000 in 2011 and $2,469,000 in 2010.

As shown in Table 6, estimates for

sales of single herbal dietary supplements in all channels of trade increased

by 2.7% in 2012 over 2011, according to NBJ. This compares to a larger growth

rate of 4.2% in 2011 over 2010. Sales of combination formulations (usually

marketed for a specific function or benefit, e.g., maintaining normal cholesterol levels, normal blood sugar

levels, urinary tract or prostate health, etc.) increased significantly by

10.8% in 2012 compared to 2011, continuing the upward trend noted in last

year’s report.

*Interestingly, of these eight

specific top popular herbs in FDM, five of them have been identified by the

ABC-AHP-NCNPR Botanical Adulterants Program as being subject to intentional — i.e., economically motivated —

adulteration.

Reference

- Blumenthal M, Lindstrom A, Ooyen C, Lynch ME. Herb supplement sales

increase 4.5% in 2011. HerbalGram.

2012; 95:60-64.

|